In Momentum strategies, one of the ways to reduce churn is to implement a worst rank held strategy. Let’s assume that the strategy picks the top 30 stocks. In the coming month if one of the stocks that is currently part of the portfolio (previous month being ranked in the top 30) is now ranked 31? Should you remove the stock and replace it with a stock that is currently in the top 30?

Stocks are ranked based not just on their own behavior but also the behavior of others. What this means is that even a stock that is doing good can get deranked if another stock does slightly better than this.

One way to avoid such unnecessary churn is to implement a worst rank held feature. Instead of throwing out a stock that is ranked 31, we can by having a feature such as worst rank held, decide to hold the stock until the rank falls below say 60 (or any other rank that you may be comfortable with).

The biggest advantage of having this is the reduction in churn. But nothing comes free and there are always trade-offs. For example, when you retain a stock that is currently ranked say 50, you are also not selecting a stock that could be ranked in the top 10.

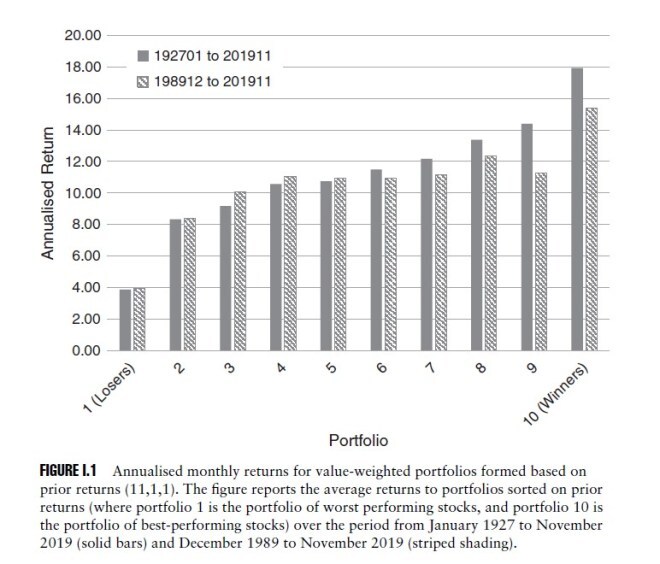

As the chart below shows, top winners outperform the next set of winners who outperform the set below them and so on and so forth

So, when we choose to retain a stock that is currently placed at rank 35 for instance, are we in a way dragging down our own returns?

We decided to test it out and see for ourselves.

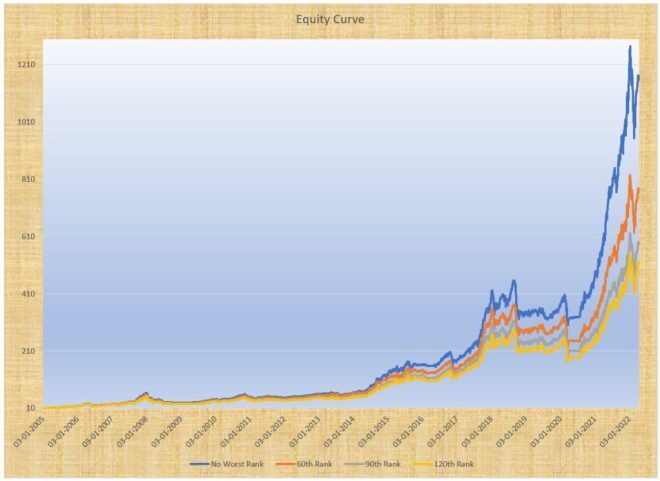

First, the equity curves plotted against each other.

The No Worst Rank held beats others comprehensively. But lets dig a bit further

The broad statistics

CAGR is best when there is no worst rank held and goes down as we increase the ranks til which a stock is allowed to continue.

But look at 60th rank as the cut off. While the CAGR is lower than for no worst rank, there are large improvements on every other score.

Median holding goes up from 2 months to 4 months, number of trades reduces by 36% and we get to ride on to one of the biggest trades (for those curious, its Eicher Motors – bought in Feb 2012, sold in December 2015).

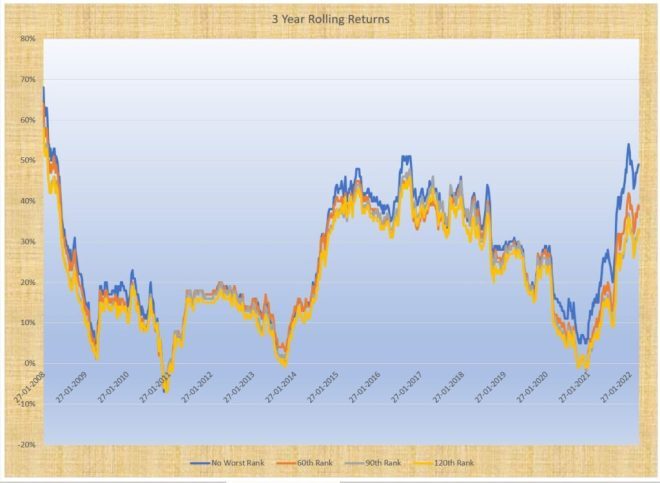

Rather than a running score, how about looking at rolling 3 year returns to smoothen out the edges?

Once again, not having the worst rank comes on top.

Every decision has trade offs. More action can lead to a slightly higher return though the invisible costs can reduce some of the outperformance. This is the same issue when we look at rebalancing on a weekly mode vs on a monthly.

While the worst rank held has value, using it blindly can lead to trouble. Understanding what the objective of the methodology is and being willing to be flexible is a way to go.