Technical Analysis has never been seen as a viable tool for generating income / wealth from the markets and the number of jokes surrounding that are legion to say the least. The Oracle of Omaha once said and I quote ”

“I realized technical analysis didn’t work when I turned the charts upside down and didn’t get a different answer.”

While I have no clue as to what chart he saw before making such a comment, I am very sure that if he saw any trending chart, there has to be a different answer if you were to invert the chart.

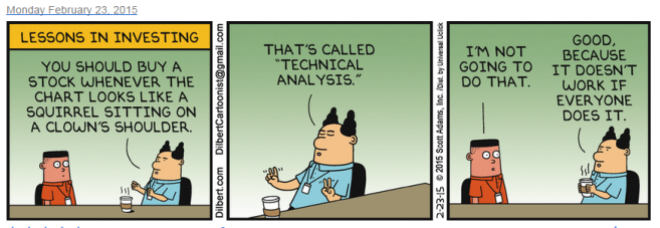

Today, Technical Analysis made its mark in Dilbert and once again seemed to suggest that technical analysis is no more than Sorcery mixed with Astrology. Before I continue on my tirade, here is the cartoon strip that will remain famous for years to come

One may recall that when Gold saw a steep fall, some one created a chart and aptly named it “Vomiting Camel” pattern. While no technical analysis books carry any details of any such pattern, with one hearing about all kinds of animal patterns, this was not entirely surprising to say the least.

While every strategy, be it quantitative or value investing has its faults, when it comes to technical analysis, one feels that maybe we are beyond reproach. Most doctors consider Homeopathy to be equal to quack medicine though I can line up persons who have been treated successfully, critics are happy to point out that its nothing more than sugar pills that are seemingly disguised as medicine. The act of curing is purely based on our mental strength and this serves only as a Placebo and in a way acts as a catalyst to cure the problem being faced.

The reason Allopathic medicine is not only widespread but also widely used is due to the fact that to qualify as medicine, it has to go through several tests (including blind tests) which try to ensure that the medicine is really effective without the healing happening due to other factors. How many of our Ayurvedic / Homeopathic / Unani based medicine can claim to have such strong test requirements?

Just today, I read that the Government of Telangana Chief Minister saying that it will construct a new secretariat building in Hyderabad since the existing one suffers from Vastu defect. Before you laugh at the ridiculousness of the thought process, do give a thought to the many who claim to have seen changes in their life owning to they shifting the door / window / bathroom / pooja room. You name it and you can find plenty of people whose lives have changed. So, should we start teaching Vastu along with Architecture?

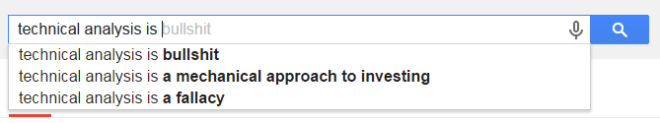

On Google, a search for Technical Analysis is provides one with the following options

Think about it for a second. A way of investing / trading is seen more as something that does not work than something which is a way to investing. Even the second option has reared its head only recently.

I am a strong believer that technical analysis works. Even though Quantitative Analysts would want you to believe that the difference between Quantitative Analysis and Technical Analysis is similar to the difference between Astronomy and Astrology, I strongly differ for the simple reason that not only are a lot of concepts have its foundation in mathematics, a lot can actually be proved much to the dismay of its opponents. Its only recently that researchers have agreed that Momentum in markets are sustainable and can be used to generate returns above what Beta says they would.

While Fundamental Analysts strongly believe in valuing the business, we Technical Analysts strongly believe that human psychology has not changed and hence patterns keep repeating the way it has done for hundreds of years now. We believe that finally, Price is King since there is no point in disagreeing with a price that the market believes to be the true value of a stock / index.

That said, the bane of technical analysis lies in patterns / strategies that seemingly cannot be expressed in mathematical terms and hard coded so as to be able to apply it without the need for a chart.

If you look at the sky, its easy to see patterns in clouds though they are nothing more than random elements coming together to play a trick on our minds. Why is it so difficult to accept then that many a pattern that appears on charts are no more than the coming together of random elements.

A lot of patterns can be hard coded and tested for efficiency and these to me are worth pursuing (if the results when tested blindly on multiple markets yield similar kind of results). In fact, a lot of hedge funds are rumored to use pattern search algorithms in order to squeeze out gains from seemingly random movements in markets.

But not all patterns / strategies are the same and if you believe that the strategy you pursue can never be coded & automated fully, you are failing to distinguish between the real and dream.

The Church for a long time held steadfast to its belief that the Earth was the center of the Universe before finally acknowledging the universally known and acknowledged truth. Similarly, Technical Analysis if it wants recognition and respect needs to accept that there are strategies that can be tested and proven as viable and there are those that are good for selling newsletters and does not actually fulfill the promises it makes about its ability to predict into the future.

Technical Analysis is to me is more than just a way to get probabilities better than what can be achieved using a simple coin toss. We may never get a Technical Analyst with the stature of Warren Buffett but we do have folks like Dunn Capital who have shown strong performance for a very long period of time. I strongly believe it makes sense to learn what CTA’s use for developing their trading models since many of them have shown handsome market beating returns without having to buy stocks / companies.

I strongly believe that long term wealth can be generated using strategies based on the concept of technical analysis. But always have a skeptical mind since its better to be seen as stupid for asking a question than seen as a stupid for having lost money using a strategy that can hold no water.

Let me end here by quoting David Hume from his book, An Enquiry Concerning Human Understanding

“In our reasonings concerning matter of fact, there are all imaginable degrees of assurance, from the highest certainty to the lowest species of moral evidence. A wise man, therefore, proportions his belief to the evidence.”