Mutual funds are on a roll. With Gross inflow of 23,000 Crores and a Net Inflow of 15,000, collections have been never better for the Industry. One key reason for the growth has been the spectacular returns by few funds in the recent past.

Recently, Economic Times report wrote about 5 funds that doubled within last 3 years (Source). Fintech companies are sprouting up left, right and centre promising to help you achieve your dreams. AMFI has been on a roll in recent times advertising even at high profile events such as the recently concluded Champions Trophy that Mutual Funds are the way to go.

And finally, Markets have been exceptionally bullish come hell or high water. With the Real Estate sector seeing reducing interest thanks to both slowing of growth as well as prices reaching way out of reality, this move to Equities is not surprising.

While the Industry is growing strongly, that hasn’t really translated into better options for Investors. With SEBI mandating a 50 Crore Networth for starting a fund, the barrier to entry is pretty high. This has translated into funds having nothing to worry. Most funds seem happy to charge as much as the regulator allows them to.

Funds with 50 Crore in Assets charges the same as one that manages 10,000 Crores. But if a fund can deliver 30% return post the charges, why complain say the naysayers.

I am not a skeptic of investing in equity or even of the fact that “Active Management” is better than passive, especially in a country such as our’s where there are just too many opportunities that big firms cannot easily take advantage of (Liquidity concerns for example).

Having said that, Active Investing not just requires one to be pro-active in markets but also have a strong philosophy which one uses to invest and the ability to stick to it come rain or shine. Since majority of us aren’t as clued it as professionals, it makes ample sense to give the money to some one who has both the time and the inclination.

A recently released advertisement by Motilal Oswal makes this amply clear

While Momentum seems a bad word to use in the world of Mutual Funds, the fact of the matter is that money chases performance. Better the performance, stronger is the growth in its Assets under Management. Larger the assets, more the Income – there couldn’t be a better incentive for everyone concerned, except of course the fund investors.

When money chases stocks, it results in abnormal valuations but as Chuck Prince once said,

When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you’ve got to get up and dance.

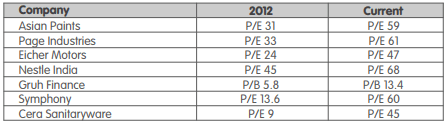

Couple of months back, Parag Parikh Mutual Fund provided this table to give a context to how sharply have valuations gone in a short period of time.

Some of these companies were maybe trading at valuations below what it should have commanded, but overall, the valuation of today seems to suggest that India is Shining with astounding growth opportunities.

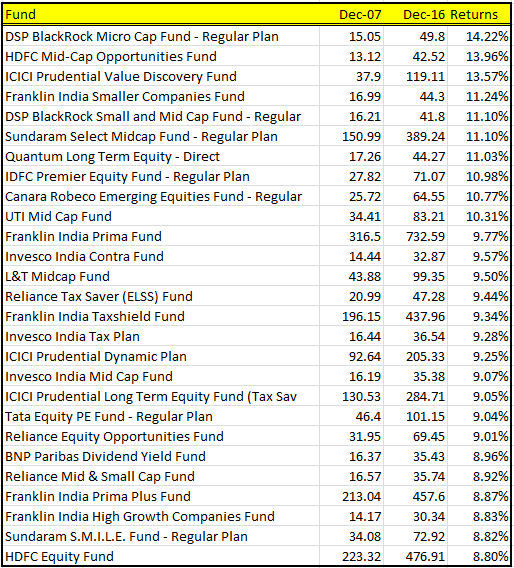

Couple of days back, I posted this chart outling returns provided by Mutual Funds for the period between 2008 to 2016. By using 2008, I was literally asking for trouble – after-all, I couldn’t have chosen a worse starting period. The objective of the exercise was not to show that Mutual Funds were bad but give a view point that just because one professes long term doesn’t mean long term results have to be great regardless of when one made a entry.

These funds are the best among all funds that were open in 2007 (December 31) and were still active on 31st December 2016.

The list is dominated by funds that targeted Mid and Small Cap stocks where much of the action is these days.

So much money has been chasing performance that DSP BlackRock in February 2017 decided to suspend fresh transactions in Micro Cap Fund.

Nifty Mid Cap 100 Price Earnings ratio today is trading at a value higher than what it traded at its peak in 2008.

In Technical Analysis, when one uses a Oscillator, one is forewarned that just because a stock reaches a over-bought territory doesn’t make it a sell candidate.,

In fact, the first sign of over-bought could be a contra-buy for much of the crowd is yet to pile on to the instrument. Its not the first staw that broke the camel’s back but the last straw.

Similarly, higher valuations alone doesn’t mean a sell. But if your Networth is overly exposed to equities (Direct / In-Direct), it makes ample sense to trim a bit of the profits rather than let all of it run.

When investors pile into performing funds without understanding the context of those returns, they are looking for trouble and disappointment. From its peak in 2000 to its peak in 2008 (8 years), Reliance Growth Fund gave a return of 5000%.

Along with Reliance Vision Fund, these were the funds with the maximum collection of assets (HDFC Top 200 being one of the other funds with similar returns during those times). But the returns over the next 8 years has been nothing similar.

Of course, Markets haven’t gone up so much you may argue and you are right. But, the question is, what is the expectation of the client who made those investments in the year 2007 / 2008? Were they expecting 4.79% return (Reliance Vision Fund) or 6.52% (Reliance Growth Fund) 8.42% (HDFC Top 200 Fund).

Couple of days back, I sat and went through more than a Dozen websites that hawk Mutual Funds. While most claim their thought process is different and hence will make a difference, when it came to advise, it was Equity all the way.

This regardless of whether I put in a time frame of 5 or 30 years. One site advised a Asset Allocation of 85:15 for my retirement. Nothing wrong except that it also gave out a 18% CAGR over the whole period. I have no clue whether 18% is low or high since we have no clue about the future inflation (other than just to guess), but by giving out a number that is way high compared to any other investment at the current juncture, its setting a very high expectation in me.

By early 2009, the current best fund – DSP BlackRock Micro Cap Fund – had gone down 75% from its peak of 2008. In other words, if the value of your investment had reached 1 Lakh in Jan 2008, by March 2009 this was down to 25,000. It requires a really strong mentality to not just hold but buy into the same (which is what SIP is all about).

Job losses was less heard of even during the peak of the financial crisis in 2008. Currently, we hear of Job Losses even as markets scale new highs. The next crash will not be similar to 2008 or even the less talked about and less known 2000 crash.

Its time you set the agenda rather than follow the agenda of some one who is more interested in how much he gains versus the risk he is exposing you to.

Very good assessment of situation. Caution is certainly needed.

On the flip side it gives confidence to the new entrant with a long yerm (10yr if u may) view that entering mkt at peaks can or may still result in positive returns 10 yrs later.

So break up your mkt entry points and hope you get few entries right.

A SIP will do that automatically.

Thanks Alok.

With regard to Sipping for a long enough period being enough to stay ahead of the curve, the jury is still out for we lack empirical data on the Indian Markets. If one takes the US markets, even at 10 year period, monthly Sipping gave just a 85% chance of being in the money (1896 – 2016).

My thought is that one needs to concentrate either in Portfolio or in Investing (Big lumpsums when market drops) to give a better chance of managing higher returns. With private markets getting bigger and public markets become way too expensive (top quality stocks), its a fight out there for sure.

What do you say regarding the PB ratio, why is it lower than 2007 and early 2008 , similarly dividend yields