Today was a record breaking day in many aspects. The opening gap down for instance, we last saw something bigger way back in 2007. The net change for the day was a 3.5 standard deviation of daily returns, something we last saw in 2008. Not a single Nifty stock ended in positive territory, not even defensive stocks which got hit (though compared to the battering many other stocks got, this was more of a slap on the wrist).

We can slice and dice data in many ways, but what it won’t tell us is whether the fall is a sign of a long term bottom being formed (panic bottoms are generally ones that aren’t easily broken) or this is just the start on what could be a long journey into the dark world of bears.

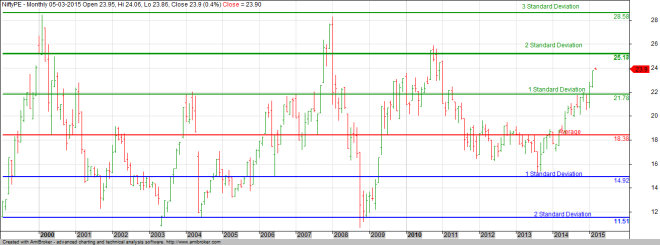

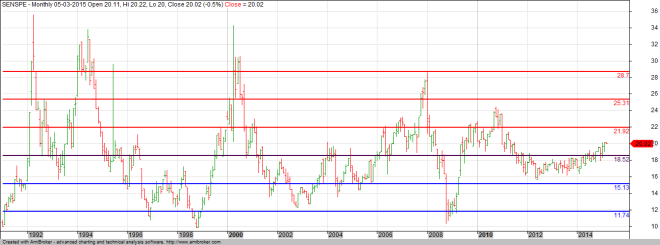

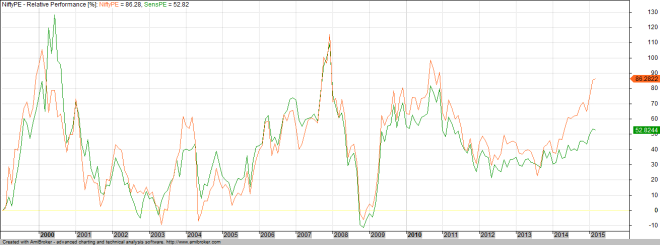

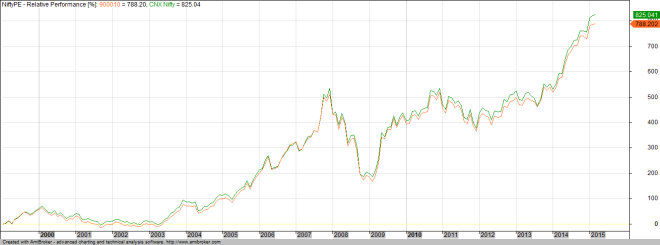

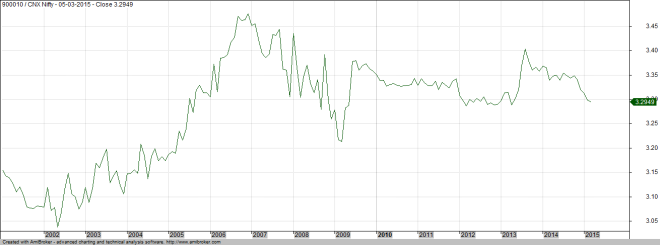

To being with, lets look at two fundamental based charts. PE charts of Nifty and CNX 500. The key reason for looking at these charts is to understand where are in relation to the past.

Lets first start off with the broader CNX 500 PE chart. While today’s fall has meant it broke down below the 2nd Standard Deviation, the fact is that even today, CNX 500 is very expensive. While there maybe pockets of value, on the whole though, market seem to be on the expensive side and since there is vast amount of evidence that buying a stock when its expensive is as bad as buying a bad stock, its tough to lay out whether we should jump in after today’s fall.

Since the PE ratio also accounts for results of the June quarter, the next trigger can only be in September if companies come up with splendid numbers. But with GDP growth slowing down, its a question as to whether companies can actually match market expectations.

On the other hand, while Nifty going by its PE is not as expensive as CNX 500, its not in the area of cheapness either and this creates a dichotomy in a way. Can mid caps correct without there being a impact on the large caps? While Nifty PE moved below the 1 Standard Deviation thanks to today’s fall, its not exactly in a area of cheapness.

After the Modi victory, markets realigned themselves with the hope that with strong growth, even if a company is over valued in today’s terms, they shall get back to normal by way of better earnings. Unfortunately, anyone who has kept a eye on earnings has been disappointed by the lack of growth in majority of companies.

In bull markets,, all kinds of reasons of why a company is not growing gets accepted without much damage to the price, but once markets starts hitting a trough, every company gets its growth put under a microscope to determine whether there is really stuff out there. We are currently at one such stage.

Today’s fall has created a lot of interest as to whether we are seeing a situation similar to what we saw in 2008. While one can only be sure in hindsight, I am pretty confident and shall stick out my neck to say that this ain’t 2008 repeat. But then again, while we remember 20058 thanks to recency bias, what worries me is whether this is a action replay of what happened in 1997 Asean Crisis.

While Indian markets were not as exposed to the world events in 1997 as it is today, by the time the bottom was made, Sensex was 31% below its 52 Week high. Even accounting for today’s fall, we are just 13.6% from our 52 Week high.

Just like in 1997 when most countries were not sure of what was happening in the Asean countries, similar is the situation today with respect to China. The opaqueness of the situation creates a scare that is larger than what may actually be the true picture.

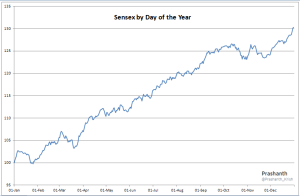

Sensex hit a 52 week low today and while that may seem damming, its a good thing since historically, the first low after a series of highs has never continued without there being a strong bounce back to scare off even the strongest bears.

While FII’s sold heavily in the market and hence maybe in a way accelerating the decline, purely based on how the Rupee has behaved against the Dollar, I believe that India is still relatively unscathed with depreciation not amounting to much (which in other words suggests that while FII’s maybe selling, they aren’t taking out money from India).

But having said all that, I continue to believe that there is no reason to be aggressively long in this market. My own Assset Allocation meter suggests just 55% exposure to equities. As a saying goes, while the early bird gets the worm, the second rat gets the cheese. Regardless of today’s fall, I continue to believe that Risk Reward wise, we aren’t in a stage where markets are a blind buy.

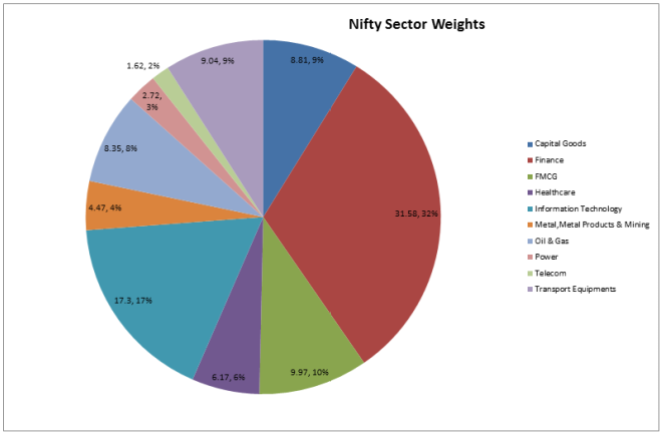

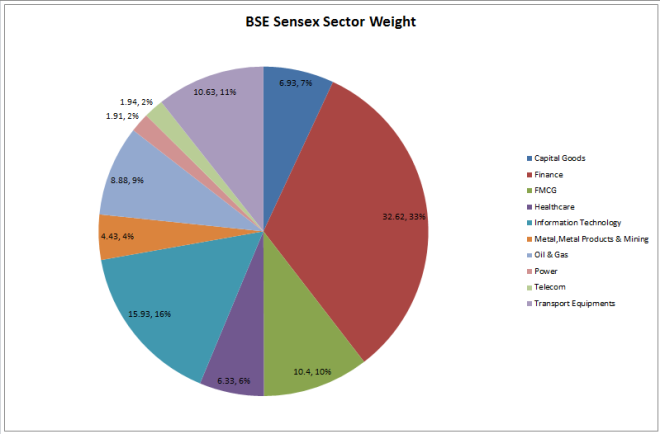

Yes, Analysts may talk about how selective stocks / sectors are performing better, but unless you believe that you can identify them in advance, the best thing to do will be stay on the sidelines with cash ready to deploy.

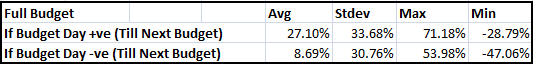

They say, Patience is a virtue and for a investor, its important to be aligned correctly since the short term (1 – 3 year) returns are dictated by when you enter. At today’s PE, the 1 year forward growth is still an average 5% but at 19, this moves to 11% which given the circumstances will be a very good return if that gets achieved.

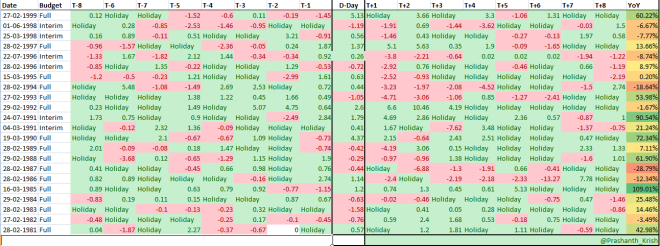

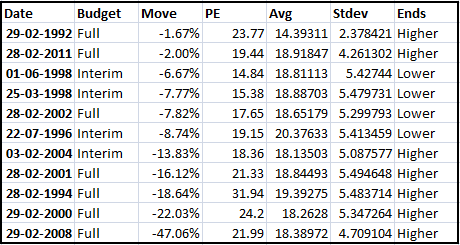

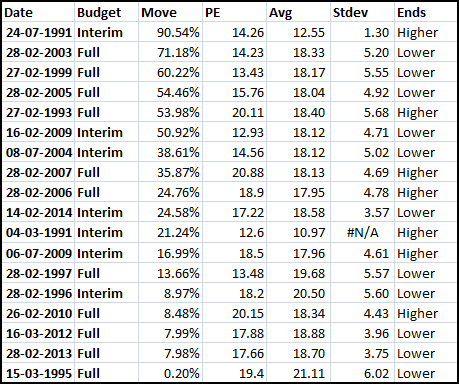

The following table should provide you with perspective on what to expect (based on historical averages) if you were to buy at X times earnings on Nifty

To conclude, if your allocation to equities is below 50%, now is the time to enhance upto a max of 60%. If you are already there, it could be profitable to wait for the dust to settle before diving in.