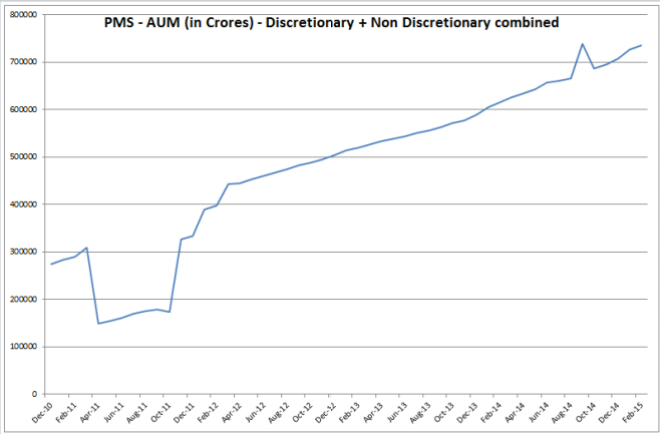

At a time when Mutual Funds are seeing withdrawals, assets for Portfolio Management Service (PMS henceforth) are blooming. This even though Mutual Funds are better off when it comes to how one gets taxed as well as the fees. Mutual funds, even the active funds charge these days much lower than what the investor ends up paying at most portfolio management companies.

For the outsider – a Portfolio Management Service is very opaque. Maybe this is what gives them the edge – the exclusivity that investors demand after having achieved a certain level of financial well being. With the minimum investment of 50 Lakhs, its a signature investment of having arrived.

When SEBI introduced the concept of PMS, the spirit behind it was that high networth individuals would want to have professionally managed but personalized investment services. Before the arrival of rules, we did have brokers who acted as fund managers but without much oversight or transparency.

Today there is very little personalization in reality with most fund managers offering the same model portfolio for all clients regardless of his or her requirements or risk tolerance. The only difference lies in their ability to have a higher concentration versus Mutual Funds.

The biggest bane for the HNI investor is that mutual fund managers are never available to speak to unless one is big enough to move the needle for the firm. On the other hand, many Portfolio Managers will be happy to meet investors and if the investor is big enough, willing to drive down to his place if required. Whoever said Money can’t buy everything evidently hasn’t worked in the financial services industry.

Analyzing a mutual fund is very easy. It’s easy to get access to the funds historical day to day returns, their monthly portfolio’s, the fund managers letters and ability to compare the fund with others in the same category using freely available screeners.

Analyzing a Portfolio Management Service on the other hand is so much harder. Almost all PMS companies are wary of any disclosure of the portfolio – not even the top holdings get disclosed. Returns on the website of the firms are generally (with exceptions) dated.

Over a three year period, an investor could end up (markets being good and performance inline) paying the fund manager a few lakhs in fees. It hence makes sense to invest some money and time to decide on whom to bet with and there is nothing like a good old one to one personal dialogue with the fund manager to convince you of the merits of your decision.

Websites like PMS Bazaar offer a way to compare multiple PMS providers but only if they have tied up with the company. As per a Business Line article, they have tied up with just around 100 firms which means that 250+ firms are outside their database.

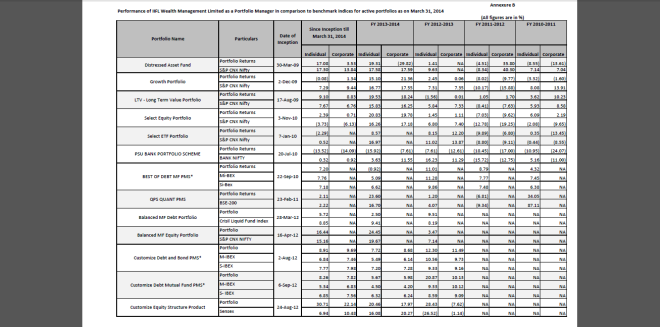

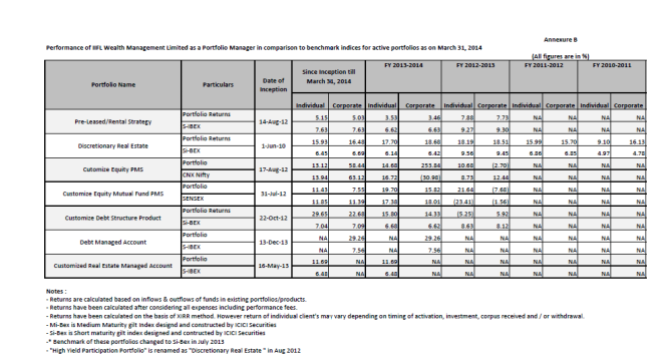

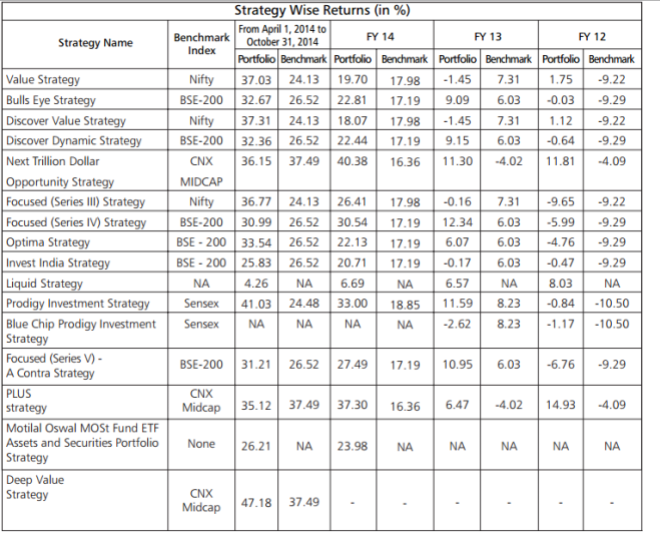

One can get the monthly returns from SEBI website where the same gets posted by the respective fund houses but until recently it was a single number regardless of the number of styles / strategies they were running. Also, did I mention the pain of trying to download data month on month for each fund house?

Returns of the past also need to be looked at with context of what is happening in the markets. In 2017, investors rushed to invest with small cap PMS funds only to get severely burnt as the markets rolled over.

Filtering down the list of suitable candidates with whom one wishes to invest is hard but essential for the next steps are time consuming. The key is to try and reduce the list of probable candidates to say 10 fund houses and then dig further.

So, how does one go about eliminating the funds one does not wish to invest into. For most investors, this process is by selecting only funds that are well known or have a large asset base or managed by a fund manager who they trust.

This eliminates the majority but also eliminates good fund managers for the single reason that they haven’t grown big for their brand to be noticed. In the Mutual Fund space this doesn’t happen because of availability of data.

Unlike Mutual Funds, we don’t have comprehensive data on how much of inflow is due to push sales and how much due to pull. While PMS is supposed to be for the discerning investor, there are still a lot of push based sales where the client takes the advice of the seller in deciding which fund he shall invest into.

In its early days, PMS was sold only by Wealth Management Firms for their clients. Today selling PMS is something that is undertaken by a whole gamut of individuals. Then again, while one shall get around 0.75% for selling a Mutual Fund, the fee a distributor gets for selling a PMS is much more liberal (some PMS share even the performance fee with the distributor who brought the client).

With minimum investing being 50 Lakhs (some PMS have a higher minimum), this for most would be a substantial investment. An investor faces two risks with any investment – the risk of an actual capital loss and the risk of an opportunity cost.

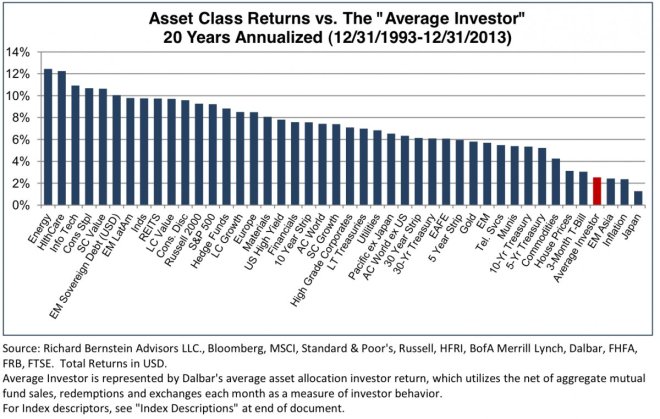

The risk of actual realized losses is easily spotted, tougher is to spot the opportunity cost. Benchmarking is one way to spot the opportunity cost. Beware though of using the wrong benchmarks for they can make an old person look young.

The best benchmark is not the Index but Mutual Funds. This is because other than for Large Caps, the other Indices suffer from a bias where their best stocks get removed frequently and thus limits their upside. The only stocks that are removed from Nifty 50 or Nifty 100 on the other hand are those that aren’t performing.

With very little if any disclosure of portfolio holdings, the next best step when it comes to analyzing a fund manager are his public writings – do note that not every fund manager writes a monthly or even a quarterly letter to clients and one that is provided to the public.

To understand a company, the key is to go through a few years of Annual Reports. Similarly, one would need to go through a few years of the letters. The idea is to get an understanding of the philosophy of the fund manager

The reason to read is that the investor would want to have a long association with the fund manager and that can only happen if the philosophy he talks about appeals to him. While returns are important, given the lumpiness of returns, the ability to stick with the fund manager during the bad times helps take advantage when the tide turns in favor of the strategy of the fund manager.

To better understand how lumpy returns can be, here is an example. A large PMS fund at the end of May 2020 had a 4 year CAGR of -1.60%. The CAGR at the end of May 2021 comes to 15%. 4 frustrating years were offset by one good year.

The only way to stay with the fund manager after seeing multiple years of gains being wiped out is only by having conviction both in the fund manager and the strategy he is implementing.

Not all PMS’s can be compared for their universe could be different. While the majority of PMS go for the Multicap universe, some PMS restrict themselves to Large Cap or Small Cap. This is an important distinction.

Size Factor is a phenomenon where it is observed that mid and small cap firms in the long haul have a tendency to outperform large cap. This outperformance comes from the portfolio’s being more risky in nature and the rewards if captured are a prize for taking those risks.

While Mutual Funds are forced by law to be more diversified – Concentrated Portfolios is the biggest differentiation for PMS. Concentration in itself doesn’t mean a higher risk though the volatility would be higher.

Finally, the elephant in the room is fees. Today, an investor can get an Index fund that costs as low as 0.20% of investment. Active funds but Directly invested by the investor would end up being charged 1% approximately.

PMS follow 3 different styles of charging to clients.

- Fixed Fee Only: The fund manager here charges a fixed fee on the total assets managed and the calculation is similar to how it is calculated and charged at Mutual Funds. This ranges from anywhere between 1% to 2.5% of your assets.

The biggest advantage of a flat fee – it’s clean and easy know what one shall pay

- Performance Fee Only: Rather than charging a fixed fee, some PMS firms offer to charge the investor a fee if they deliver above a certain hurdle rate. From the limited data I have, I have seen this hurdle rate being 6%. Given that until recently you could get 6% from a Risk Free Investment, this hurdle was in effect saying that if I don’t outperform the risk free, I don’t get paid. The way it’s calculated is that if a fund generates say 12% returns for the year, for an investment of 1 Crore and a performance fee of say 20% above 6%, you will pay 1.2 Lakhs (which is equivalent to a fixed fee of 1.2%).

The reasoning behind charging only a performance fee is to suggest that the fund manager will get paid only if he delivers for the client. While on the surface it seems logical, do note that in the long term, an Index fund has on an average delivered 12% returns.

Lower the hurdle rate, higher the fee the investor will end up paying. In good years like FY 2020 – 21 when Nifty went up 66%, the fee would come to 12 Lakhs( or 7.2% of the total current value of the fund – post 66% appreciation on an investment of 1 Crore). This of course assumes you invested on April 1, 2020.

While the investor will not pay any performance pay till the high water mark, if he were to exit during a drawdown, the investor would have ended up paying more than what he may have paid using the simple fixed fee route.

- Fixed Fee plus Performance Fee: Finally, there are funds that charge you both a fixed fee and a performance fee. The hurdle rates here are a bit higher but not that high that makes it tough to generate any performance fee in the long run.

While this is how most Hedge Funds charge their clients, this is also in a way trying to maximize revenue for the fund manager at the expense of the client. In a good year like the one just gone by, the fee would easily be multi year fees for any active mutual fund.

Performance fee in my opinion should be calculated on the Alpha generated over and above the opportunity cost. The opportunity cost would be what one would have chosen as an alternative investment. But there is no such model available as far as my knowledge.

In addition to the fees, PMS also passes on all incidental expenses that are directly relatable to your account such as Broking, Demat, custody etc. This can easily come to 0.4% and something to keep note of.

For the investor, the biggest difference is how one gets taxed with respect to gains. If one is investing for the really long term, say Retirement Goal, with a Mutual Fund one pays Zero taxes as long as one remains invested. In a PMS, it’s normal for the investor in a PMS to regularly pay capital gains taxes on profits books by the fund manager.

Depending on the holding period of the fund manager, this can dampen the returns substantially if there is a high degree of churn. It goes unnoticed for most until the time to pay the tax arises. But in a good year, one is already happy and he or she is unlikely to complain with respect to paying taxes for the investment has grown substantially too.

The biggest advantage of PMS is the transparency (once you are a client) with respect to transactions. You get to know each and every transaction which while may not be really useful in the larger framework , it can provide you inputs on the thought process of the fund manager.

Once upon a time, Stock Brokerage was a personalized business which allowed the broker to charge you 2.5% and then some more and yet have the client not complain. Technology rudely awakened that Brokerage is finally no different from any other commodity business and the friction costs have reduced to Zero.

With the advent of more low cost ETFs that cover a gamut of strategies and tech enabled platforms, my view is that managing one’s one money based on one’s own convictions will become easier. While managing money may never become a commodity business, over time fees should go down from what is seen as acceptable today.

A new concept that is picking up in the US is “Custom Indexing”.An interesting concept where the advisor or his client has the ability to modify the portfolio to suit their custom requirements. Patrick O’Shaughnessy has a podcast which is worth a listen (Link).