Tag: nifty

Meb Faber Timing Model on CNX Nifty

For a trader, its essential that any strategy he uses needs to at least in historical testing beat Buy & Hold returns (and since we assume a lot in our back-tests, higher the returns compared to B&H, the better). After all, the argument here is simple. If you spend time and effort in markets, the least you should be expected of doing is beating the guy on the street who may have just bought nifty bees and went into deep sleep.

Then again, that may not entirely essential to a investor whose idea is to get a return better than other asset classes and if one comes with lower risks, the better.

The biggest advantage of Buy & Hold on Nifty Bees is its simplicity. You buy it and you can forget all about it. X years later, your returns shall closely mimic the returns of the Index (some variations shall exist due to tracking error).

The biggest disadvantage is that when Index falls big, your investment gets hurt too. For example, a guy who invested into Nifty Bees 2006 would have seen his returns being absolutely zero if he had checked in late 2008 / early 2009. A FD on the other hand would have paid him much higher returns without a iota of risk.

The best way to beat the markets one is told is to buy good companies and hold on (forever). But here too, it comes down all to when you enter. Let me give a example. I doubt you shall be able to say that buying Warren Buffett’s Berkshire Hathaway is a stupid strategy.

This is what I tweeted a couple of days back

An investment into Berkshire Hathway ($BRK-A) at close of 1998 as of today would have yielded a CAGR of 7.66%.

I do not know whether a CAGR return of 7.66% for Americans is huge, but the fact that you could have bought a Treasury Bond (30 Year) which was yielding 5% returns at the same time (End 1998) says that the results aren’t way out of whack with the expectations that could have been made. But I am digressing from the agenda.

Beating the markets on long term is tough. The survivors we see today hide the huge lot of fund managers who have literally disappeared. And beating the markets without having similar draw-down is even more tough. Even the best managers go through tough draw-downs that can send a chill down any investors spine.

Meb Faber some time back talked about a simple strategy. Rather than repeat what he has to say, I would recommend you to head over and take a look – http://mebfaber.com/timing-model/

I tested this strategy on Nifty (using Nifty Total Returns Index to ensure that we account for Dividends which get missed when one uses only Spot Nifty). The results are outlined here;

Test Period: June 1999 till date (December 2014)

Total Raw Returns: 9162 Points (higher than CNX Nifty since it includes Dividends).

System Returns: 8288 Points.

Raw Draw-down: 48.81%

System Draw-down: 26.71%

Raw Holding Period: 173 Months

System Holding Period: 131 Months

Raw Number of Trades: 1

System Number of Trades: 12 (last one being Long from November 2013)

Buy Price & Sell Price = Opening price of the next bar (1st trading day of next month). No Transaction / Slippage charges used.

But the big issue with directly using above data is that you cannot buy Nifty Total Return Index. Instead, what if one uses Nifty Bees. Nifty Bees has a tracking error (bit outdated data) of around 0.20% and a cost of 0.50%. Compared to other options available, this is the best.

In my search on that issue, stumbled upon Kiran’s blog where he has provided some stats on the same out here

All in all, I think for some one who wants to invest directly into market (some Mutual funds have outperformed strongly, but too much of Survivor bias makes comparing them apples to oranges) and yet not get caught when markets drop like a hot potato, this simple strategy is worth a look.

Mother of all Bull Markets

Evenings on Twitter are generally spent talking about either our markets or the US markets. Today though, much of the discussion so as to say was with regard to making fun of RJ’s target of 1,50,000 for Nifty, mind you Nifty and not Sensex by 2030.

Extrapolation is easy given the tools we have at our disposal. But should the ridiculous target broach us away from the fact that on the long term, markets have gone only one way – Up. And before you point me Nikkei, I would request you to start your Nikkei calculations not from 1980, but 20 – 30 years earlier. From that point, even after the relentless weakness, Nikkei is still very much in positive territory.

Big targets always make nice talking points, but unfortunately, investing for that kind of growth requires a certain rigor and discipline that is not seen in most of us. The best way for 95% of folks is to have a systematic investment plan to invest X% of Salary into a few Mutual Funds (Large Cap / Small Cap) regularly come rain or shine.

Of course, doing that will mean that you may not be able to see your accounts double in a year but what it will ensure is that at the end of 15 / 20 / 25 years, you have a sizable amount as savings which has grown at a rate which would not be possible in most other asset classes (including Real Estate, though there will always be exceptions).

At the current juncture, market’s aren’t cheap by any meaningful measure, but if you are looking at the very long term, any entry is as good as another. Even opportunity costs can make a huge difference in end results.

RJ is no Buffett and as his recent investment into Spicejet shows, even when he invests into what he believes is a solid bet, his allocation is so small so as to not hurt him if it fails. But, the bottom line is that, unless one takes some kind of risk, one can never hope to get a reward.

Markets are cyclic in nature and at some point in future, we could see even a fall of 50% from the top, but if you wait for it and the 50% drop comes after market itself has moved 100% from here, you are still worse of compared to what you would be if you had invested. Worse of all, its easy to say that one will invest when blood is on the street. When blood really flows, rarely do even those with a plan can stick to their plan of action. Fresh investments generally never happen at such times even if RJ says, Sell your House, Buy Nifty 🙂

The biggest advantage (as of right now) into Equity investing is that Long Term returns are Tax Free. This is something that no other asset classes offer and if you were to believe that India has a long way to go as we try and catch up with the developed world, no date is too late.

Getting the right perspective #Nifty

As long as the going is good, one has not a care of the factors that are driving or the factors that are being ignored. But as soon as the markets start to react, all the worst kept fears start coming up as the reasons markets may continue to fall and even though markets are already down quite a bit, commentators make it seems that this is just the start of a massive fall that can continue for long.

Since 2008, every fall (and we have seen a nice intra-year correction every year, but more of it later) is seen as the start of the fall which will be similar if not even more severe than 2008.

In 2013, markets made the low of the year on 28-08-13. On that day, we closed 14.58% below the highest close of the year. The key reason ascribed for the fall was “US military action on Syria”. Of course, while Syria continues to burn, markets themselves made a splendid recovery.

Its interesting how media can blow up news to make it seem that the End of Day is nearby. This India Today (Link) report seemed to suggest that the end for India was near – Doomsday being the word used. Do check the date of the report – its a day before markets bottomed out. Markets closed the year flat (gaining around 20% from the day of the low).

23rd of May 2012 was when markets made the low of that year. On that day, Economic Times carried a article which quoted the following

“It seems all grim,” Morgan Stanley’s Ridham Desai said in a note. “The macro mix exposes India to global events more than it may choose to.” Morgan forecasts current account deficit — the excess of imports over exports — and fiscal deficit to fall this year, which will help equities.

Another reason for the crash was Greece. Remember the PIIGS? While once again, we are yet to see there being any recuperation by those countries from the hole they dug themselves into, markets recovered pretty strongly. In fact, one of the reasons that is being ascribed to the current fall comes back to the issue of Greece.

December turned to be a pretty bad month for Indian markets in 2011 as it capitulated towards the close of the hear. Instead of having a Santa Claus rally, we saw the fear of Halloween. The whole year as such was one of bearishness but the final cut came as RBI did not cut CRR as markets expected in face of a weak IPP indicated a economic slowdown. Analysts were worried about the worsening asset quality of banks, especially those in the public sector.

While markets did not recover in 2011, we saw one of the best rallies with the start of 2012 with January and February posting a very strong up-move.

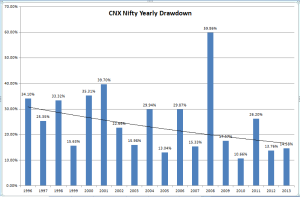

The average draw-down we see every year comes to around 13% and this year, we had not seen a deep draw-down till date. Even after today’s fall, we have fallen just 5.43% from the peak of the year.

As the above chart clearly lays out, from the top for the year, Nifty has in no year retraced less than 10.66%. Some food for thought, eh 🙂

I strongly believe that the current situation is not anywhere close to what we witnessed in 2007 / 2008. By almost all parameters, we are much better, much cheaper and better equipped to handle any fall out that may arise out of international events. But with markets becoming volatile, its easy to lose perspective and go with the herd. The herd unfortunately as evidence has pointed out many a time in the past tends to act wrong at the worst possible time.

In my earlier view on Nifty, I had said that this time maybe different. While markets had immediately bounced back, the reasoning I had was not unfounded and I believe that even now, some more pain maybe on the cards. But instead of rushing to the exit, that maybe the best time to load onto stocks that you had missed when it had rallied earlier.

This time its different #Nifty

After weeks of nightmares about how to fund today’s Marked to Market margin, Bears finally had something to be happy with Nifty cracking by 1.3% by end of day. While a 1% fall in markets should be common enough, it was something that was missed in the last 24 days.

In a bull market, one is told that the best way to participate would be to buy on every dip. While it makes a lot of sense in theory, the question is how to apply it practically. After all, how does one know whether we have seen that dip or not.

Unlike most pundits on Twitter and Television, I do not have a crystal ball to say where one should Buy or Sell. On the other hand, with the help of some Statistics, its possible to compare contexts with how markets have behaved historically and come to a educated guess.

Lets first start with the most basic question. Have the markets gone up too much too fast? In the last one year, markets have gone up by around 60% and considering the circumstances in which this has happened (change of government, US markets in a strong bull market, economy seeming to show signs of bottoming out among others), this is something that is acceptable. After all, markets discounts the future and markets believe the future is pretty good compared to the immediate past.

The key difference between the current bull market and the one’s we have seen previously (2000, 2003, 2009) is that those rallies were born out of pessimism. Markets had become pretty cheap (when measured via trailing Nifty PE), we started off the rallies with Nifty PE being around 10 whereas in the current instance, markets started off without being too cheap (we never dropped below 15).

Today, Nifty 4 Quarters trailing (Standalone) PE stands at 21.09 and just a few days ago tested the 1 Standard Deviation. Coincidentally, this is the same level from which markets reacted in 2003 (chart below) and while the circumstances are hugely different, some reaction from this level maybe given as per this data.

Previous bubble burst’s have happened when Index was well over teh 2nd Standard Deviation (and pretty close to the 3rd), so in this instance, we can rule out the possibility that the current rally was a bubble and the hope that this may result in a straight line fall.

This rally has been different in a lot of ways, much of which I believe is due to the Quantitative Easing that has resulted in a flood of liquidity resulting in most markets seeing a very low historical volatility and a constant bullish undercurrent.

Take a look at the following chart for example

The lower pane shows the number of weeks since we saw a 5% cut (on weekly). Since 2010, we have had just 1 week where markets fell by more than 5% (week ending 18th November 2011).

Now check the following chart

Between 2003 and 2008, when Indian Markets saw their best bull markets ever, we had reactions coming in constantly. The longest period we spent without a week where we saw a 5% correction was 74 weeks (compare that to 148 weeks we are seeing currently).

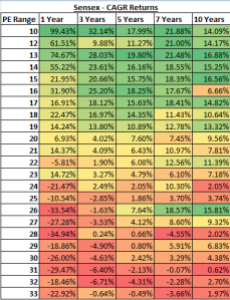

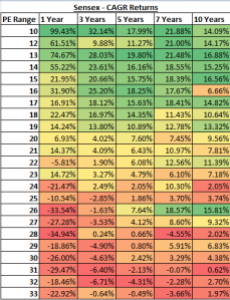

As much as I believe that the future looks good, the best returns are found when we buy it cheap. The markets are not as cheap but not very expensive either which puts us in a dilemma. Take a look at the spreadsheet I had posted in July of this year

As you can see, above 21, the returns over the 3 year time frame get into negative territory. Of course, this being the average, you may see a +ve returns as well, but the probability goes lower as we go higher.

Technically speaking, we have not seen a good support range appear after we broke above the previous high of 6300. Interestingly that is also a level breaking which we are sure to get into a bear market.

A 20% reaction from the current high while may not appear to be in order, we have had a draw-down of 13% (Average), something we have not seen in 2014. So, even if we were to react 10% from the high, that would mean a test of 7300 levels.

For now, fresh investing can wait till we see a moderate correction at the very least.

Trading vs Buy & Hold on Nifty

For a long time now, I have been advocating that any strategy that does not beat Buy & Hold returns is not worth following. The basic reasoning behind the said thought is the fact that Buy & Hold is the easiest way to earn money in markets and unless additional returns can be generated by trying to time the market, it makes very little sense to do anything at all and instead spend the time and effort in a venture of our choice.

But on the other had, the advantage of using a systematic strategy is that the probability of your draw-down being lower than the market is pretty high. While deep cuts do not happen at regular intervals, when they do such as in 2008, its always better to be out of the market (or better short the market) than twiddle the thumbs and hope that the markets start to react back to higher ranges.

Lets for sake of example, take a simple Moving Average Crossover – EMA of 3 crossing EMA of 5. The reason I have chosen this particular multiple is due to the huge amount of discussions that have happened previously as well as the fact that this is one of the best cross-overs among the many others than I have tested. But the fact does remain that this strategy (MA Cross is known for a very long time though much work in my circles has been done by Vish)

If I were to test the same with zero commissions and zero slippage (on Nifty Rolling Month futures from Start of Series in 2000 till date), we see that the strategy would have given us a profit of 7272 points in Nifty vs. a Buy and Hold (and ignoring for Dividends) which would have given us 6018 points in the same time span.

Since futures positions are generally created using leverage, this is not exactly a apples to apple comparison. But before we do that, lets include some transaction and slippage charges so as to make the results more realistic.

Those of whom have been trading for long would remember that its only in recent times that we have brokerage the kind Zerodha offers. I still remember paying 0.05% brokerage even in 2003 / 04. While brokerage has reduced, we now have STT to partially offset the gains from lower brokerages. Slippages too have reduced over time.

Since the back-test is being on a extremely long period of time, I would hence use a 3 times leverage with transaction charges kept at 0.03%. Now, lets look at the results once again.

The gains that we now have is close to 18750 points which comes to a bit higher than 3x of Buy & Hold. 3x of No Transaction charges would have given us 21816 points. The difference is what the cost of the transaction would equal to (on an approximate basis).

But this is not the end result either. You see, while a Buy & Hold investor has the advantage of not paying any tax on the gains (Long term gains being Zero), the same is not true for we, the short term derivative traders. The income so gained is seen as Business Income and charged under the slap which the investor comes into.

For sake of argument, lets assume that we fall under the highest slab and hence lets charge 33% of gains as tax payable. That would reduce our gains to 12562 points. Way less than what we initially started off with but still a little more than double what we could have made from a pure Buy & Hold strategy.

And what about the risk you may ask. Well, the risk (if you measure it through say Draw-down) is actually lower than Buy & Hold. While Buy & Hold would have seen you bear a max system draw-down of 60% (in Oct 2008), in the system you would have seen a max draw-down of just 18.5%, a number which is much more tolerable.

And best of all, I have not compounded my positions through the 14 year test. Even if one used a basic position sizing algorithm, I can assure you that the end result would be way higher than what has been showcased here.

Of course, what is life without some hitches along the way. While you have been a happy man in 2008 reaping your best profits even as the rest of the market was seeing blood on the streets, you would not be so happy as on date what with your strategy under-performing the markets since December of 2012 (current draw-down being 6.51% even as Nifty has moved by 1500 points in the interim).

The above trend following strategy is just a simple example to showcase how one can beat the markets even after accounting for all costs that are not accrued by a Buy & Hold investor. But that said, it also requires tremendous discipline since trend-following strategies generally tend to under-perform strong bull markets (this above strategy for example did not make a cent in the whole of 2007).

While Technical Analysis as seen on Television has been reduced to some sort of astrology, the fact remains that the true aim of technical analysis is to have the ability to reduce the risk. Once the risk of failure is controlled, its always easy to find a way to make more than what any other strategy can provide for.

Do note that I have not taken roll-over costs into account in the example above since I believe that the probability is high that over such a long period of time, roll-over costs shall cancel each other out (since we also take and rollover Short positions). But that maybe something to test some other time 🙂

A easy way to make money in markets

Is making money in markets easy? Well, its both Yes and No. Yes, if you are positioned rightly, making money is as easy as pie. And No, that does not mean that money can be made without a process driven approach and definitely not by trying the luck in markets when the whole herd of sheep is headed that way.

The simplest way to build wealth is by buying when cheap and selling when expensive. Fundamental Analysts go a long way to analyze what is cheap and what is expensive and while many do get it right, its not something that can be attempted by every other investor who may neither have the time nor the expertise in reading through and understanding balance sheets, cash flows, management guidance among others.

A easier way would be to buy the broader markets when markets as a whole are cheap and selling when they start turning expensive. I have in the past written about how one can use Index PE to determine where the markets are placed at the current juncture and use that info to decide what is the ideal strategy.

So, before we go any further, lets look at the monthly chart of Nifty trailing PE (Standalone)

As can be seen in the chart above, we are well below what can be said as over-valued though the caveat is that the price earnings is based on past earnings and if future earnings are bad, we may see the PE rise even without there being much movement in the Index.

On the other hand, we do have some cushion due to the fact that we use Standalone results to calculate the earnings instead of Standalone which is at a higher keel. But since the data we have is Standalone, we shall stick to that for the time being.

While its true that a picture can say a thousand words, I believe that its better to stick to numbers to be sure of what the chart conveys in reality.

While the above chart if of Nifty, I have used the Sensex PE to calculate returns based on where we entered. The reason for using Sensex data was that it provided me with a much larger sample size compared to Nifty.

What I have tried to do is calculate the Compounded Annual Growth Rates based on where the PE was present at that time. So, if the PE was at 20.5, its returns would be recorded in the 21 frequency (representing all data from 20 to 20.99)

As you can see , the best time to buy would be when the PE ratio is between 10 to 19 and the worst time would be when PE is above 24. Save for the two green picks at 26 PE for 7 years and 10 years, almost all of the rest is the worst returns for the period. Even the outlier is more due to happenstance than something which is worth pondering and investigating further (just for info, the sample size of PE between 25 and 26 is 2 – months of July and August 2000 being the data points). Even in that outlier, do notice that the 1 year return was a negative 33.5%, something that is not easily digestible even by die hard bulls, let alone normal investors.

As on date, Sensex PE is at 18.26 (Source: http://www.vectorgrader.com/indicators/india-sensex-price-earnings) or is at 19.2 (Source: http://www.equitymaster.com/india-markets/bse-replica.asp?order=eps%20desc) .Either way, we are at the top of the band and unless we see strong earnings growth in the coming quarter results, any strong gains from hereon will only push the PE of Sensex into area where the probability is high that returns will be below par.

While I still believe that the markets are a Buy on dips, I would wait for a larger correction to jump in (add to existing positions, that is) than jump in at the first sign of correction.