Serendipity the occurrence or development of events by chance in a happy or beneficial way. For me, meeting Sameer as his family lovingly calls him was no different. Its been 8 years of learning from some one who has an innate ability to question (with data) and think out of the box. Its a pleasure for me to have him co-write this post (my contribution is just the narrative, the real deal is his data and numbers).

If you are on Twitter, you should by now be used to ism’s of every kind on how to go about building wealth in markets.

Bhave Bhagwaan Che say Investors who follow Price without really explaining how one reduces the number of stocks from hundreds to something more meaningful and easy to execute.

Buy Stocks for the Long Term say Classical Fundamental Investors without mentioning how to find stocks that will still be around 10 years from now let alone have generated wealth.

Financial Planners on the other hand say, don’t worry about Portfolio or Returns but about whether you can reach the goal.

Everyone loves to talk about stocks and why not. Stocks are more volatile, Stocks can be storified and Stocks finally are about their underlying Business and it’s easy to make a case for or against a stock. Add to it, it makes for good party talk.

So, What is a good portfolio?

A good portfolio is something that contains just the right amount of stocks and yet is diversified enough to provide protection from the vagaries of nature.

Charlie Munger whose quotes you will find tough not to come across for example has a portfolio that consists of just 3 stocks. Thes stocks he holds, Berkshire Hathaway, Costco and Wells Fargo. A caveat though – Gurufocus shows his portfolio as 3 but omits Berkshire and instead has Bank of America.

When you look at the number you may tend to feel that this is an overly concentrated portfolio but if you dig deeper you know that though Berkshire Hathaway is a single stock, it’s actually made up of more business and variety than what many indices can provide.

When we invest in real estate, we don’t diversify. We make a commitment that is most of the time larger than our Networth in a single investment. Never do we worry what if I have picked up the wrong location and one that will go down in value. While it’s true you cannot really compare a house with a stock, even in the world of investing there are options where you can safely invest 100% of your net worth and be diversified enough even though you hold a single ticker symbol.The Vanguard Total Stock Market Index Fund for instance.

From Mutual Fund advisers to Asset Management Owners, I am yet to come across someone who will suggest that a portfolio can be diversified by holding just one fund. On the other hand, I have come across Advisors who suggest their clients to buy 2 of everything – Large Cap, Mid Cap, Small Cap, Multi Cap and for good measure a couple of thematic / balanced funds.

In a way, this is a hedge for Career Risk. In 2017, Client is happy seeing the returns of the Small Cap fund while in 2019, the large cap funds would have given him solace and in March of 2020, the Balanced Funds would have proven their worth. Client is Happy, Distributor is Happy and of course the AMC is happy. What more can you ask for?

But, when it comes to stock, how many stocks should you hold? Well, it depends – if you are betting on say Nano Cap Stocks, the more the better for the odds of success is low but it provides the optionality when a few stocks hit the jackpot. But if you are betting on large cap stocks, do more stocks add value or just another number

Vijay Mallik has a post (2015) where he says that you need nothing more than 30 stocks to be well diversified

Well known Financial Advisor and Planner, D Muthukrishnan on the other has this to say about how many stocks to hold

This month I completed 1 year on Single stock investing. Yes, you read that right – the entire portfolio is composed of a single stock. This post is a note on experiences – the good and the bad of holding just one stock as against a portfolio composed of multiple stocks.

What do I mean by a Single Stock Portfolio?

Well, it means what you think it means – the whole portfolio consisted of just one stock at any point of time unless I went to cash in which case, it would be Zero stocks.

But isn’t such a portfolio risky? Well, it depends.

Prashanth a couple of days ago ran a poll asking whether a portfolio of just 3 stocks invested in 10% of Networth was more Riskier than 30 Stocks invested across 100%

Though it can be argued either way, the distinction is pretty clear – a 30 stock portfolio may offer diversification but when you invest all your money is more riskier than a 3 stock Portfolio that is diversified across just 3 stocks.

Among the many manifestations of risk 2 of them are well known

1) Market Risk – The part of risk that comes because of the market. In March when the bottoms of the market fell off, stocks regardless of their fundamental strength took a tumble. You can view this as being similar to collateral damage suffered by Innocents during a War. Unfortunate and rarely can be avoided

2) Stock specific risk – This is the risk where you have a much better control. A fundamental investor would say that given that he knows the company better, he is able to reduce the risk even though other factors – Market Risk for example can cause the stock price to cause quotation risk.

One way to limit the impact of Market Risk on any given portfolio is by having a trailing stop that exits the whole portfolio on breach of certain levels. Larger the portfolio, tougher is to execute. On the other hand, with a one stock portfolio this becomes fairly easy – the number of decisions you need to take is just one.

This is similar to trading say a Dual Momentum Strategy using Nifty and Liquid Bees with the only difference here being that instead of Nifty we are long a single stock.

In most diversified portfolios, you may find that on any day the number of winners and losers tend to be in line with the broader markets. On days when the markets bullish, you find a lot of your stocks to be doing well and when markets are bearish, most of the portfolio stocks

This is not too different in a single stock portfolio where unless there is company specific news, one tends to observe that stock is up when markets are up and stock is down when markets are down.

The key to ensuring that the portfolio doesn’t destruct itself is by ensuring that the stock is chosen with a certain amount of care to eliminate the risk of getting caught in stocks that can go up in flames in no time at all.

One year generally is too small a time frame to analyze any strategy let alone a strategy that is dependent on the fortunes of a single stock at any point of time but 2020 is not any normal year and while its too early to say that we have seen all we need to see, the correction and the recovery has been something that we have never seen in the past. In the US, a technical correction like the one they saw in 1987 took 3 months for recovery vs just a month this time around even though much of the country is closed and the Virus seems not to let up regardless of how strictly people are quarantined either.

Almost every Entrepreneur is by nature holding a portfolio of just one stock – the company he owns. In fact, for most, its 100% of their networth and more given that in addition to owning the business, their debt is backed by personal guarantees and personal assets. While theoretically they have a greater knowledge of the business than we as shareholders can claim to, they also suffer from the illiquidity of not being able to exit when the tide turns around.

The way to become rich is to put all your eggs in one basket and then watch that basket.

– Andrew Carnegie

In a way, the single portfolio is similar. We place our bets on a single stock and then watch the stock very carefully. There is this risk that some news may come out either during the trading day or post close and one that could know the steam out of the stock and that risk gets magnified since instead of our exposure being 5 or even 10%, it’s 100% which means a death blow from which one can not easily recover.

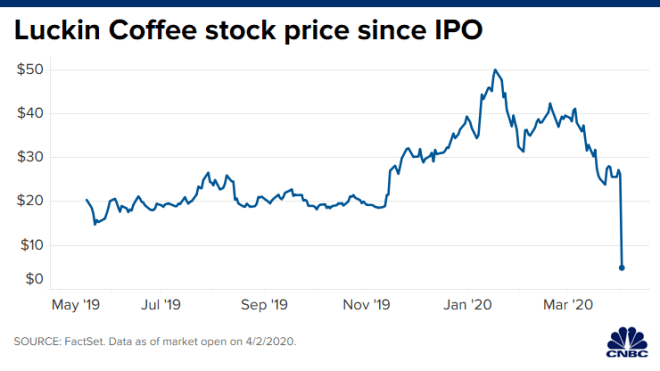

But this is actually rare even though news would suggest it to be normal. Take for example the recent case of Luckin Coffee. The stock fell 80% when it disclosed that an internal investigation has found that its chief operating officer fabricated 2019 sales by about 2.2 billion yuan ($310 million).

But this did not happen with the stock trading at an all time high. Rather, the stock as you can see in the chart below was already down 50% from it’s all-time high. This is not a one off either as history shows that rare are the occurrences where the stock reverses immediately from an all time high without giving the slightest of opportunity. As with everything, there are exceptions to the rule – Vakrangee for instance gave barely breathing space to any investor before getting locked in lower circuits.

It goes without saying that there is ample amount of Luck involved. But where it isn’t really speaking for Luck plays the role of a catalyst that can change fortunes a great deal. So, how has been the performance. The chart below provides a visual of the same. Do note that at any point of time my allocation was limited to 50% which means that true stock return would be double. But given that allocation was my choice, it’s important to be true to the objective which in this case is to try and observe the Pro’s and Con’s of such a strategy.

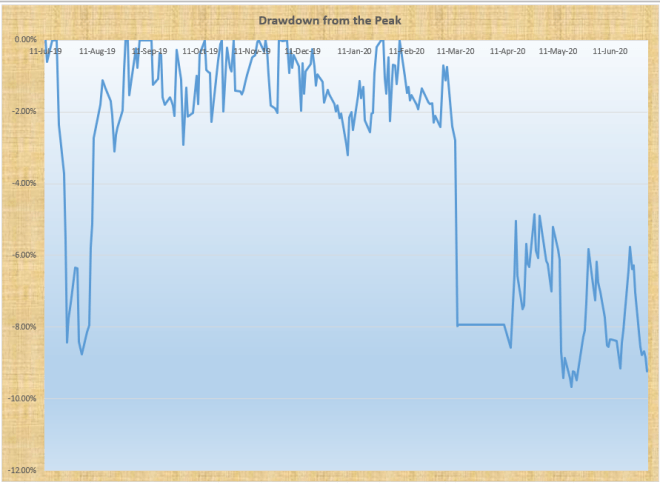

Risk as you know can be defined in many ways but one of the best ways is to measure the draw-down from the peaks. This provides us with an ability to understand how much we lost at any point of time.

As soon as I started, the portfolio hit a draw-down of 8% and one that was reclaimed by the end of August. As the NAV shows, the strategy equity kept moving higher without deep interruptions till we got bit by Corona. The stock I was in breached the pre-existing stop and the portfolio went to cash.

I will not go deep into the stock selection strategy other than saying it’s based on Montecarlo based evaluation of historical draw-downs and tries to select a stock that provides max buck for the risk taken. Exits happen when the stock draw-down goes below a certain quartile that has already been seen in historical data as the point after which risk starts to balloon up but not so much for the reward.

It’s a strategy that I am sure most will not be comfortable with, but also a strategy that allows you to understand the nature of the market better than what you could accomplish by being long 100 stocks at any point of time. Diversification in itself reduces but never can eliminate risks as we have seen time and again.

If you have any questions, do ping me on Twitter or better still, Portfolio Yoga Slack Channel. If you are not there, do join using this link (Portfolio Yoga Elite Slack)