When markets crack and they do crack all the time, it doesn’t really matter whether your portfolio is made of high quality stocks or low quality, your portfolio will take a hit. The only difference would be in percentage with high quality portfolio’s tumbling way less than low quality portfolios.

Derivatives were introduced to enable long term investors to take a hedge against short term corrections using options. But using options as a tool to protect portfolio from falls such as one we saw on Friday doesn’t come cheap.

Nifty 50 closed at 9965 on Friday. If one wanted to take a hedge, the best way would be to buy a At-The-Money (ATM) Put Option. A Put option, for those who don’t trade Derivatives, makes money when market falls. With October Futures traeding well above the 10K mark, the ATM option to buy would be the 10,000 Put.

Nifty 50 contract size is 75 and with the strike price at 10,000, this means a exposure of 7.5 Lakhs. In other words, if you have a portfolio that is totally correlated to Nifty 50, buying one contract of Nifty 50 should be enough for every 7.5 Lakhs of Portfolio Value.

But portfolios are rarely correlated to Nifty 50. While last week saw Indices dipping by 1.2%, the Median fall witnessed among Large Cap Funds (Direct) was 1.47% with the worst performer being Taurus Starshare Fund which fell 2.72%.

Nifty Midcap 100 Freefloat Index and Nifty Small Cap 100 Freefloat Index fell by 2.9% each. I would assume most investor portfolio’s fell by as much or more. This suggests that buying 1 Lot of Nifty 50 Put may not be actually enough to protect the downside.

The Nifty 50 10,000 Put of October closed at 135. One unit hence shall cost Rs.10,125. In other words, the cost of Insurance for a month will cost 1.35%. Not bad but then again, one needs to remember that most portfolio’s require more than 1 lot for every 7.5 lakhs of portfolio. At 2 lots, the cost now doubles to 2.70% – an amount that will disappear if Nifty closes anywhere above 10,000 on October 26, 2017

A better way to Hedge?

The risk of hedging using options is that by the time the market falls eventually, you may have run out of patience to keep buying puts and seeing them expire worthless.

A simpler and better way is to reduce exposure by way of Asset Allocation. While we all want to maximize when markets are going up, its tough to bear the pain when markets turn the other. This also means that when markets drop, you have cash to deploy rather than be part of the herd that pained by the enormity of the fall is waiting to just off load at any price.

Markets have changed dramatically since 2008. Any one looking into the past and hoping to invest when markets fall like they did in 2008 has been waiting for a very long time even as markets have gone one way up.

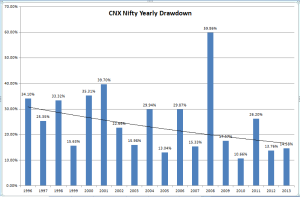

The chart above depicts draw-down from 52 wee highs that were seen in Nifty from 1995 to 2008. While we have more deeper corrections pre-2000 than post-2000, we did see some regular deep cuts. From 2003 – 2008, Indices rose 500% though we did have two cuts of 30% or more.

The same chart but now showing the 2009 – 2017 time frame. Not a single reaction of 30%, forget more. Comparing and Contrasting the two charts suggests that what earlier was 30% is now 20%, what was then 20%, now more of 10% and what was 10% now more of 5%.

Of course, this is no suggestion that we may not see a 50% or higher fall in the coming years – there is nothing like never again. But while probability of a fall of 50% or more is low, that is not the case when market tanks 10% or 20% from the peak.

We saw a 10% fall towards the end of 2016, a year which began with markets continuing to drop and finally bottom out 25% below the peak of 2015.

You asset allocation should take into account, the kind of loss you are willing to suffer if market crack 10% and yet have allocation that you can add more at that point as at the point when markets down 20% and later at 30%. I am using round figures though you are free to use any number you feel is place where you should start investing more.

The final objective needs to be that you are at the maximum exposure you are comfortable at the worst possible time. The negative of this strategy is that you will never be at the maximum for most of the times and that is okay if you understand the thought process is more about enabling you to stay through the journey.

To get a better understanding, here is a table that lists the draw-down in Nifty (from 52 Week Highs) using the Percentile method

What the above two data charts point out is the probability of market draw-downs > 40% from Year high of 52 Highs is pretty slim. Yes, we have had instances of market falling 50% or more, but as the above data shows, the amount of time markets spend there is less than 1%. This Analysis was conducted using data from 1990 to 2017. In 27 years, markets spent less than 14 week below such levels.

Waiting for the proverbial shoe to fall generally means that investors add more risk to their portfolio’s when they should actually be reducing and when that results in disappointment, reduce risk when one needs to add.

Reducing draw-down comes with a reduction in returns but what use are returns of the future if we cannot live through a draw-down? Food for thought?