Support and Resistances are the key tools of technical analysts who rely on the chart for making their assumptions. The key concept here is that of human psychology. A support is a place where the markets have made a bullish reversal earlier and one where one can expect fresh buying to come in and a resistance is a point where the price had taken a bearish reversal and hence when the markets came back to the same point next time around, you should see some amount of selling.

Rather than re-write what has been written in multiple books, I shall instead reproduce here what Jeremy Du Plessis writes in his authoratitive book on Point and Figure.

<Book Quote starts here>

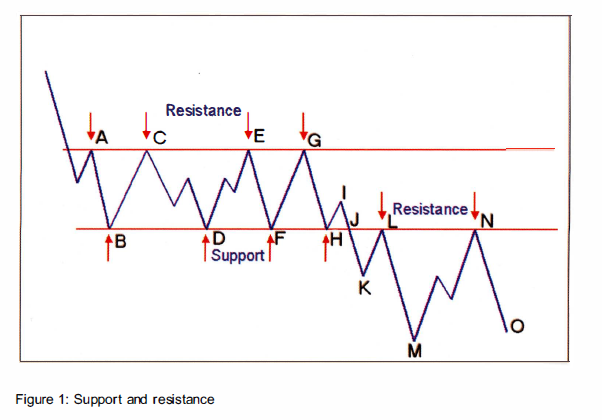

The price is in a downtrend. It pauses, reacts back up to point A, and then falls to point B.Technical Analysts do not reason why it did this; it is simply understood that supply and demand caused the price to move in this way. At point A, buyers were not prepared to pay any more and so the price declined to B, where the buyers were prepared to start buying again.

You have to remember that the market is made up of lots of participants with differing views and obj ectives. Buyers who bought at point B may take profits at point C. However, there is another group who bought at point A, are pleased that the price has risen back to the same level at point C, and are pleased to get out of their position. This collective view causes a resistance level at point C and causes the price to move down from point C.

Remember, buyers at point B made a good gain when they sold at point C, and so when itgets down to point D they start buying again. This creates a support level, where buyers are prepared to take an interest again. This demand pushes the price back up again. Once again, at point E, they start selling, reinforcing the resistance level at that level. This causes the priceto decline again until it reaches support at point F, where the same short-term traders, who have bought at B and D before, start buying again.

Point G is as far as the price gets again because the short-term traders have become confident that it will not go higher, and so the resistance at that level gets stronger. It declines again to point H and, once again, the buyers come back again, creating support for the price. The price bounces to point I and then falls back to point J. The same buyers who bought at point H are pleased that they now have a second chance to buy at the same price at point J, but this time, the sellers are in charge and force the price below point J. It is important to consider how the participants feel about this. Buyers had become confident buying at the same level and

making a profit, so much so, that they probably were buying increasingly more each time.For the first time, they are in a losing position. Some will sell their positions immediately, creating a selling frenzy that pushes the price down. Others will, however, hope and pray that the price will rise back to the price they paid. Point K is the point where the price has become oversold. That is, it has fallen too far too quickly, and short-term traders looking for a quick profit start buying. This forces the price back up to point L briefly, where the new buyers take a quick profit and some of the B, D, F,H and J buyers sell to break even. The move to point L is short-lived as so many sellers appear. So, the level at point L, which was a support level, now becomes a resistance level.The price falls to point M.

There is no reason why the price stops at point M. It could be at any level. It is simply a point where demand exceeds supply and the price is driven back up again. It is important to pause and consider the psychological make-up of the participants. There will be a large group who bought at the B, D, F, H and J levels and are still holding their positions. What is going through their minds is ‘if only the price can reach the price I paid, I will sell out and never buy another thing again’ ! This creates even more resistance at the L level, which is the same level as the previous support. So, when the price does eventually rise back to that level, those who have been praying start selling at point N, reinforcing the resistance level and forcing the price down again to point or lower. The level at points L and N will remain a strong resistance until there are no sellers left at that level.

The important point about this scenario is to understand that levels of support and resistance do occur on charts and that they occur for psychological, not fundamental reasons. When support is broken, it is important to recognise and understand that support becomes resistance to any up movement and that this is also caused by psychological reasons. Although not shown in the diagram, resistance, once broken becomes support to any down movement. So support and resistance alternate.

<End of Book Quote>

Trend following on the other hand does not concern with Supports and Resistances as those defined in the chart above. What Trend following looks for is a reversal of the current trend. So, at none of the points mentioned does a trend follower get a signal to reverse his existing position.

Trend following is always a late comer since it first waits for evidence of the fact that the trend has really turned around to Bullish / Bearish. Only once the confirmation (based on whatever approach you have), does one get a signal to reverse the signals and bet on markets moving the other way.

When you assume markets to reverse from a support or resistance point, you are in affect claiming the power of prediction where none exists. At any resistance / support level, what is the probability of a reversal happening? I would say its 50-50. It may happen, It may not. But if the whole probability is just 50%, why are Support / Resistance lines looked upon with such flavor?

The reason in my view is that this happens due to the fact that we see what we want to see. Lets use a real example, the Daily chart of Nifty.

I have marked all previous tops as they occurred. As you can seem only once or twice was the next low in line with the previous top. Most times, it made a low where there is theoretically no supports or made a high where there was no resistance (the Dotted line for instance).

Markets being a game of probabilities, do you really want to go with nothing but a theory that is seen as good just because we can find evidences of it working (Selection Bias anyone?).

Nowadays everyone calls himself a trend follower as trend following has become the faith to be seen in (just like all folks on the fundamental investing side want to be seen as Value Investing, even when they are investing in stocks like Bosch 😉 ), but true trend followers never trade based on rules that cannot be tested historically using a automated program.

After all, its well known that the mind has the ability to see patterns where none exist and similarly, we are adept at seeing support and resistances where they worked while if you were to codify it, you shall see that its a strategy that does not have a Edge.

Nowadays I am starting to agree with the philosophy of “Whatever Works”. If it works for you great, but do remember not to confuse strategies just because some one says they are one and the same.

The reason Asrtrology / Vastu and even Homeopathy is looked down upon is not because it has not been proven to be right ever. Search enough and you shall spot enough folks who shall swear by it. The reason why they are not accepted by the scientific community is due to the fact that they cannot pass tests designed to remove the human bias and behavior pattern for instance.

In Technical Analysis, unless you remove the bias of the self, any pattern / any strategy can be seen as one with excellent characters where none may exist. In a way, its amazing that while we understand the reason why lottery ticket buying is a waste of money given the low probabilities of it working for us, we fail to reason out similarly low probability strategies that are abound in the market.

Until you are able to sieve the wheat from the chaff, the results will always be sub-par – something that you could have got without having to go into all that trouble in the first instance. Food for though. eh? 🙂

First of all thanks for the post.

I am trying to understanding your post.

Does it mean, better be a long term investor and give preference to fundamental analysis over technical analysis and buy stocks to considerable margin of safety to their intrinsic value?

Sorry, some times a lot of what I write seems to come out like Mumbo Jumbo 🙂

That said, my thesis is simple. If you are a trend follower (whatever system you may use), do not look at Support / Resistances (on chart). Can only be detrimental to the final results vs out thought of that being positive.