An often repeated mantra is that if you don’t start saving early, you end up losing tremendously. You cannot argue with a statement like that , especially when it’s backed by evidence of the difference in returns if you start at 20 or start at 30.

Keeping in mind my skepticism with much of what goes around as “gyan”, I made this kind of sarcastic tweet in reply to one such tweet. Now, just to be clear, I hold Dinesh in high regard for his understanding of Finance and while I did use his tweet as material to push my agenda, it has nothing to do with him perse.

Kids in the US are burdened by Education Loans they take. The burden is so heavy for some that they would need to keep paying off till retirement. So, why do they even bother? The reason is simple – higher the education, more the remuneration and lower the possibility of being unemployed

One would rather be employed and paying off debt than unemployed with no debt but no optimism about the future either. While I don’t think that education in itself is everything, it’s a foundation that can help a lot.

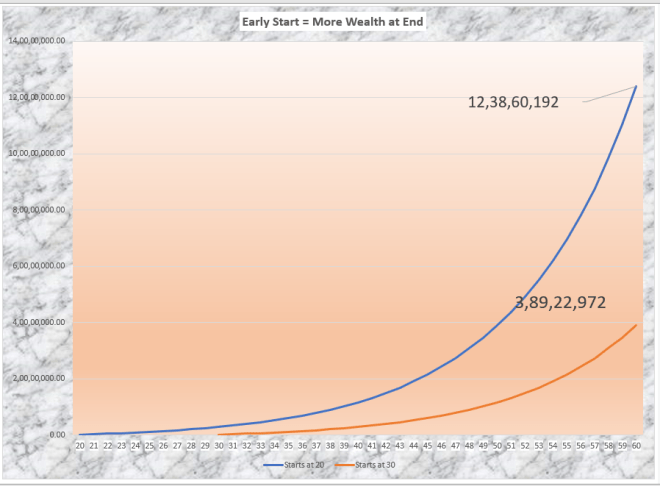

Let’s go back to the original tweet. What is seen is the difference in outcomes based on a straight line approach to savings. If you start saving at 20, you are way better off than someone who starts to save at 30 assuming both end at 60. This is not surprising and it’s not just about compounding effects. Person A is saving for 40 years versus Person B who is saving for 30 years. 10 years of savings and the compounding does matter as the chart below shows

There is a very big hidden assumption here. Not only is Person B starting at 30 which is 10 years later than Person A but he is investing the same starting capital. What if rather than invest 10K per month, he is able to invest more?

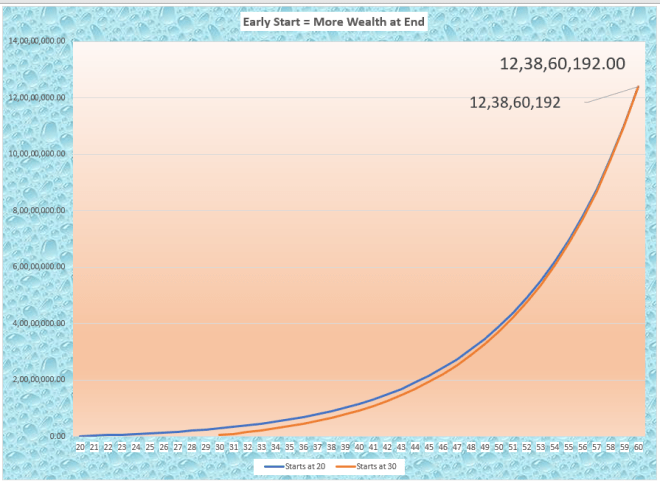

When he is 30, Person A is investing roughly 16,300 per month (10,000 per month with an increment of 5% per year). If Person B starts his year 30 by investing 31,800 per month (close to double what Person A is investing) which too increments by 5% per year, this is what the chart looks like

Basically, by starting with a higher number, Person B despite starting late is able to catch up to Person A.

But he is investing more, you complain. This is true. My assumption is of course that he has not whiled away his time between the age of 20 to 30 but gathered either diverse experience which helps him earn more or got himself a higher degree which provides a higher salary and hence even with a similar savings rate is able to save on an absolute terms a higher number.

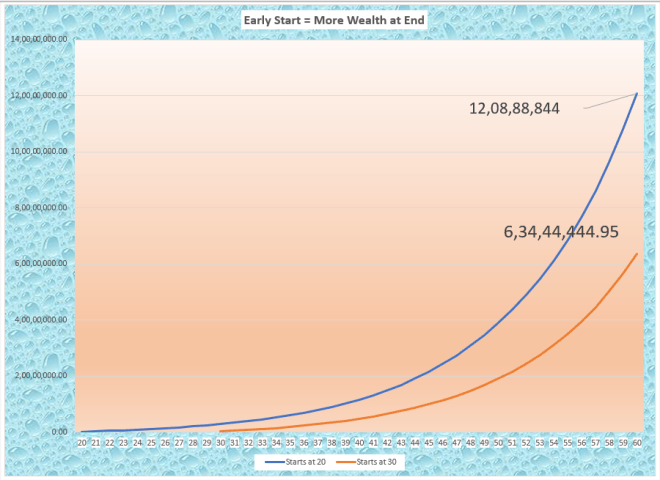

But lets equalize it in a different way – let’s assume that both work for the same period of time – 30 Years. Person A hence retires at 50 while Person B retires at 60. When Person B starts to invest, we assume he will invest the same amount per month that Person A is investing at that point of time and increment 5% per year. Where will they be when they hit 60 years of age?

We are back at Point 1 though slightly better. Person B trails Person A by nearly 50% even though Person A has retired a good 10 years earlier.

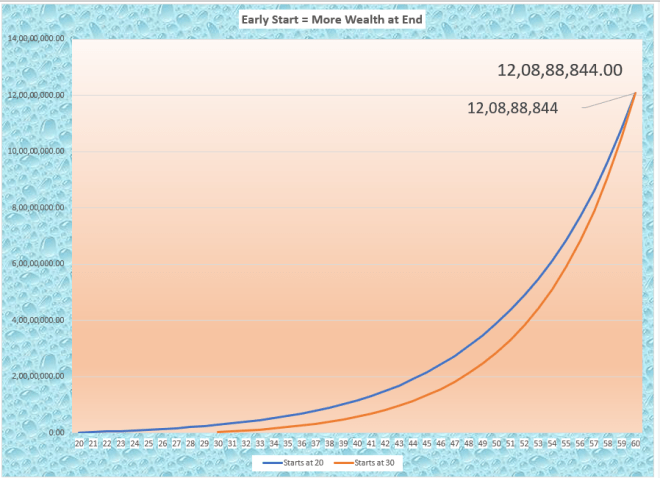

But there is another assumption we are overlooking. We are assuming that both of them get similar returns. How much of a higher return should Person B get to catch up with Person A at the age of 60?

The answer to that is 15%. If Person B can get 15% per Annum vs 12% per Annum for Person A, at 60, both of them end with a similar capital.

Here is the interesting thing. Both Person A and Person B can expect 15% from Equities and still end up at the same outcome at the end. The difference though would come from Asset Allocation.

While Person A can have a 60 / 40 Asset Allocation in favor of Equities and reach the number as Person B who is forced to have 100% in Equities. In other words, though both have similar return expectations from Equity, the allocation they need to take will be different.

For Person B to have the same outcome as Person A with the same Asset Allocation, he will need to generate 20.3% from Equities – something that very few have been able to achieve in the long run.

On the other hand, Costs can play a large role in the final outcome. Assume both invest in Large Cap Equity but Person A invests through a Mutual Fund Distributor in a Active Large Cap Fund whereas Person Invests in a Large Cap Index Fund / ETF.

While both of them will hold a similar portfolio {minimum of 80% matching}, Person A is paying a 2% fee vs Person B who will end up paying 0.10%. That is a straight forward gain of 1.90% and actually reduces the requirement for Person B to outperform Person A by that much. To get 15% returns in Equity after fees, Person A has to have a fund that delivers 17% vs Index fund Returns of 15.10%. If you have looked at SPIVA data recently, you shall notice that most Large Cap have it hard beating the Index let alone by that margin on a long term.

When we were young, we were taught the concept and Importance of Savings by stories such as the Ant and the Grasshopper. I don’t think we should deny the importance of a disciplined saving from an early age. But is everything lost because you started late though the barriers are higher.

While I do like the message of saving early being good there is nothing to be scared about if you started out late. Finally, it’s not the amount you have at 60 that really matters as much as the quality of life you have lived. The very fact that you are reading this puts you into the 10% of the population and one that is most likely to succeed as well.

Want to Stress Test your Retirement – check out the simple calculator(s) here. Of course, the assumptions build in here are US related, but should give you a chart of how other paths than the one excel plots.

One thought on “Save Early or Lose Substantially?”