We are all familiar with Notional Loss and Permanent Loss but what about Opportunity Loss (Cost). Compared to the other two, this is not painful since Ignorance is Bliss. But then again, while the other two losses are something that has occurred due to action, opportunity cost is one which takes place due to inaction.

For Investors, the cost of opportunity is not being able to en-cash the gains in their portfolio. Warren Buffet says that he loves to hold stocks to infinity (speaking in a literal sense). But how plausible it is for a ordinary investor who has invested his money not to make wealth for the next generation but to achieve certain targets in his own lifetime.

A portfolio of IT stocks would have skyrocketed in value when the 2000 IT boom happened. Once it burst, the portfolio could have never recovered even though its been 14 long years. Even a Index (which has the advantage of being able to jettison weak stocks and add new stocks instead) like the Nasdaq Composite has not been able to conquer its 2000 peak. If you consider the impact of Inflation, the break-even cost will be even higher.

A portfolio which was heavy on Infrastructure / Energy would have seen it soaring in value in the years between 2005 – 2007 (in India). But how long before they come back to their highs (and will many of them even survive in the interim).

Some stocks though have never bothered to look back too much. But the question that you need to ask yourself is, how likely do you think that your portfolio consists of such stocks and hopefully everything bought at prices which are not tested when the larger trend reverses?

Some Small caps move onto Mid Caps and later on become Large Caps. The question though is, what is the % of stocks that advance such. On the other hand, what is the % of stock that move the other way round.

Index stocks are seen as the bluest of the blue-chips. But 20 yeas later, how many companies have survived and thrived. If you had bought (for equal amounts / stock) all Sensex stocks in 1994 and looked at your portfolio today, the CAGR gains you would have seen is somewhere around 12% (Of the 30 stocks, 29 are in existence with Philips India being the only company that got de-listed).

If you were to think that maybe investing in Mutual Funds would have given you a better return, think again. While you would have gained handsomely if you had invested in Kothari Templeton Prima Plus, your investment (adjusted for Inflation) would have wiped out if you had instead invested in CRB Mutual Fund (and both were launched in the same year, 1994).

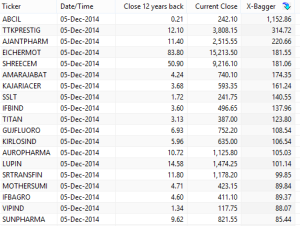

Ask any stock broker / Analyst and he shall be happy to share the huge gains that could have been made by investing right and sitting tight. Heck, as the list below compiled by friend Girish showcases, your returns would beat the hell out of any other asset classes

Of the list, I have been into a couple of stocks. But then again, like any other investor, I have not held to-date and missed a pretty nice opportunity. But then again, I do hold a couple of stocks which have given me 100x returns (UTI Bank / Indocount), but since my quantity of purchase is small, even though the percentage returns seems awesome, the amount is pretty meager. A lakh of Rupees 10 years back is not the same 10 Lakhs now.

In fact, its not about identifying a 100x opportunity but ability to buy it big is the key to making wealth in markets. But how many have the confidence to buy a stock and invest say 10 / 20 or even 30% of their networth into it?

Recently I was reading a tweet by a Mutual Fund manager where he professed as to how investors would have made handsome returns by investing in markets and as an example showcased how Sensex has grown to 27,000 from 100 in 1979. What he forgets is that 100 was the base price and secondly, there was no way to invest into Sensex / Nifty till 2002 when Benchmark Nifty Bees came into the picture. So, when people talk about the long term returns of market, do take with a few kilo of Salt.

Over the last few days, Russian Markets have literally imploded. Things have come to such a pass that one is hearing that people are buying iPhones to hedge their currency risk. What is the probability that we may get hit with something similar and what is the plan of action if that does indeed happen. How hedged is one’s portfolio to international moves that we may have no control.

Without a plan, most of us move with the herd making it easy for the hunters to cull us. But how many have financial plans in the first place. Today youngsters take loans which they repay for most of their lives to buy asset such as Land / Appartments. While that has worked well in last 15 / 20 / 30 years, what is the probability of it working in the next 30 years?

We are happy to see advent of Flipkart / Uber / Zerodha among other disruptive companies. But what if the next disruption makes us jobless with our domain expertise not worth the price we deem its worth. What is the plan of action?

Writing this blog is a way for me to express my inner thoughts and if its boring, I apologize. But think deep, do we have a plan to achieve our goals if the Plan A bombs. How many have a Plan B or even a Plan C to take care of us when shit hits the fan?

A couple of interesting recent reads that may have influenced some of the thoughts above;

How Adam Smith Can Change Your Life: An Unexpected Guide to Human Nature and Happiness

Hand to Mouth: Living in Bootstrap America

Do check out the books above. Deeply inspiring to say the least. Made me think of what Warren Buffet calls the Ovarian Lottery and how lucky we are (regardless of the challenges we face).

This has been one hell of random writing. Thanks for reading. Hope its worth your time

sayonara 🙂

Prashanth, you are correct…It is not identifying the right opportunities , it is about investing a big enough amount in those right opportunities that should be a game changer for our lives and personal balance sheets. Even if we managed to select the best performing stock or mutual fund for the next decade ,, it hardly matters if the invested amount is not sufficient enough to propel our wealth creation. I have realised this in the past couple of years and changed my investment amounts accordingly.

Yes…the final note strike the cord… I don’t have any action plan(proper) for Plan A itself. The reason 80/20 or what Robert kioyosaki call 90/10 is that only 10% of the people creates wealth in the long run, it takes lot of patience and ground work to fall in the 10% category. I m striving to fall to that and I hope one day I will accomplish it..