International funds have been around for long. Value Research says that the oldest fund in existence is Principal Global Opportunities Fund which was launched in 2004. As on date there are 46 funds that come under the category of “International Funds”.

For a really long time, International funds did not command any interest. Even today, the total assets under management is just around 21K Crores of which the top 3 funds (two of which belong to Motilal Oswal) have cornered 40% of the total assets.

Only in the last couple of years have International funds started to gain some traction. For instance, currently Motilal Oswal’s Nasdaq 100 ETF has a AUM of 3,203 Crores. Thes same fund in March of 2018 had an AUM of just 72 Crores.

Performance drives Assets under Management. This is a universal truth. Very few investors or advisors will stick to a fund that is underperforming its peers. There are exceptions always like the HDFC funds in India but this is mostly true for most funds.

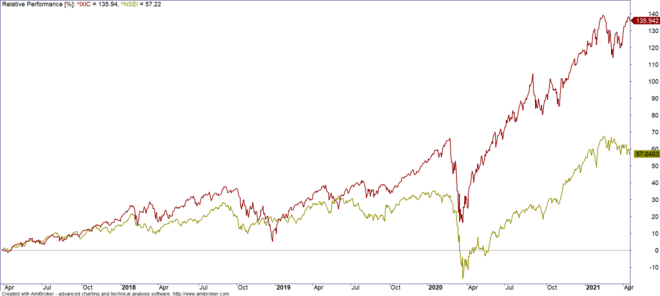

Look at the performance over the last 4 years between Nasdaq 100 (^IXIC) and Nifty 50 (^NSEI). Nasdaq 100 being denominated in USD while Nifty 50 is in INR.

For most part, Nasdaq has been outperforming Nifty and this margin has increased big time once the Stay at Home policies kicked in response to the Corona crisis. Tesla for instance shot up 743% in 2020 alone. Why would a car company’s stock shoot up during a crisis when you barely got out of the home? One – there was a fundamental change. The EPS went from Negative to Positive and Secondly the future earnings go rerated. Trailing Price to Earnings ratio shot up above the 1000 mark. The share got split in 2020 making it cheaper for the YOLO community to invest as well.

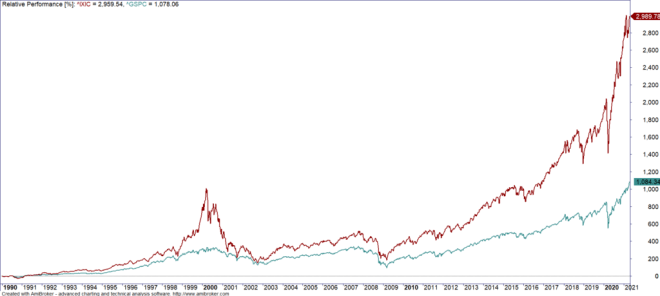

Tech has been the driver for a while now. If you were to co-plot the S&P 500 where the weight of Tech shares have oscillated over time but is not a entirely technology index vs a pure technology index, you can see that despite the fall in 2000, Nasdaq has delivered 3x the returns of S&P 500.

Mirae is now coming up with a fund that aims to outmaneuver Nasdaq 100 by investing in just the best 10 stocks (mostly by way of Market Cap / Opportunity size I assume). After all, if 100 is better than 500, surely 10 is better than 100 🙂

In India, we barely have any access to top edge technology firms. Most of the better ones in India are privately held and the big daddies who are listed are more of service oriented companies where you can get a steady return vs the lumpy nature of returns promised by the leading edge tech firms.

When I started on my Momentum, I tested for position sizes from 5 to 100 and time frame from daily to yearly. The idea was to check what would be the most optimal. Optimal doesn’t have to be the Best. I finally settled upon 30 Stocks and a monthly rollover. If I wanted to target the most profitable I would have probably gone for 20 stocks and a much lower frequency of rebalance.

The key reason I went for an optimal and not the best possible portfolio structure performance wise was because I was building the portfolio for myself and I wanted this to be my one and only portfolio. I was and even today happy to sacrifice some gains for the ability to deploy the majority of my networth in this strategy.

There has always been confusion as to how much of International Stocks should be part of one’s own portfolio. While Warren Bufftett has invested outside of the United States, it’s barely anything compared to his investments in America.

Bogle dismisses international diversification. Buffett, meanwhile, says an index fund portfolio of 90 percent S&P 500 and 10 percent Treasurys is probably good enough for most investors.

But their advice is for Investors of the United States. What about for Investors in countries such as India? Does it make sense to diversify your savings to investing outside of the home country (home country bias is a bias that is seen everywhere) or does it make sense to stick to what we know best.

For any investment to make sense, it has to be a significant part of one’s portfolio. An investor with an investible surplus of say a Crore of Rupees won’t be making any difference if he invests anything lower than 10 Lakhs. But a larger allocation comes with its own risks. While it’s been a long time since the Dot com bubble, do note that Nasdaq not just fell 78% from the peak but it took the Index (where the constituents keep changing over time) nearly 16 years to move past that high watermark.

For the S&P 500, the high of 2000 was tested as early as 2006 and finally broken in 2013. Max drawdown S&P saw was to the tune of 50%. While the Indian markets too got pummeled post the Dot Com crash, the Index recovered and broke the high of 2000 as early as late 2003.

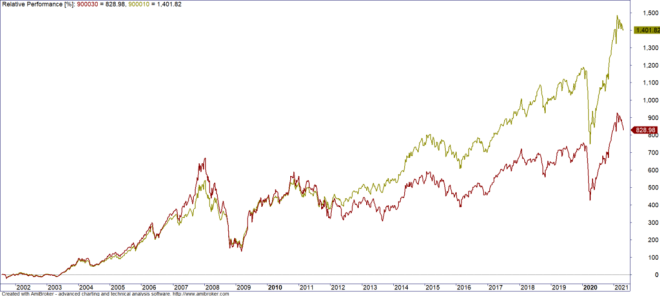

The biggest advantage of International Investing is the currency hedge it offers. If you had invested in the Sensex at the peak of 2008, today you would be thinking you are sitting pretty. After all, Sensex has moved from 20,000 odd then to 50,000 odd a few weeks back.

But if you were an investor in the same Sensex but had invested using the US Dollar, your gains would have been just around 75 (absolute not CAGR for the entire period of Jan 2008 to April 2021).

For those of us who are in the developing nations, one way to ensure that our purchasing power is kept constant is to invest in asset classes that are denominated in the US Dollar. This is one reason why Gold has emerged as a way to save for its movements are not based on the demand supply in India but demand supply worldwide and one that is denominated in Dollar.

But should that mean you should go out and invest in a 10 Stock portfolio that comprises the hot names of today? While the stocks will change over time, the risk is two fold –

One: Most of these companies have grown way too big and while that brings stability in the business, it also means that the future returns will not be as attractive as the past.

Secondly big companies can get caught in Regulatory issues concerning market domination. Facebook and Google are facing that already in the United States while Alibaba has been made to pay for the missteps of its founder Jack Ma.

Technology will rule the next century, that is guaranteed. But the Winners and Losers will not be easily identifiable in hindsight and by the time a winner has been found, it may be too late to enter even though they may still provide market+ returns.

A small allocation will not move the needle and a large allocation will mean that you should be willing to bear a risk of deep drawdowns that will definitely be seen by products of this nature. If your time horizon is 20+ years and you have the ability to not panic when the chips are down, this could be an attractive investment, else it’s worth giving a pass. The Nasdaq 100 is still a much better bet if you wish to bet on technology firms.