“We’re too soon old and too late smart.”

For nearly a month now, I have been wondering if it made sense to make a post of the trails and tribulations of my one year journey with momentum investing. The idea here is not to sell you a product or a service but to provide you with an insight that is missing out there when it comes to Momentum.

I have been part of markets for more than two decades now and there isn’t a stone or a strategy I haven’t tried and mostly failed in an endeavor to find “The One” J. From Value Investing to Intra Day, from Forex to Coat Tailing, from futures and options to exotic options, there are very few things that I haven’t tried out.

The key to success as I understand comes down to your belief and knowledge of the strategy you implement. Borrowed conviction or strategies may give you a high once in a while but more often than not, will eventually knock you down.

Thanks to Mohnish Parabai, Coat Tailing has emerged has a very interesting strategy that can be applied in the markets. But unless you actually buy in the same proportion as the person you are coat tailing, your returns will be very diverse from the one whom you are attempting to replicate.

I believe in experimenting in markets – yes, it can turn out to be expensive but it also provides you with immense know-how and understanding of what works and what doesn’t.

The foundation of progress has come through Risk bearing Experiments. Not all experiments end up successfully with many would be inventor getting killed in the process but for those who did survive, rewards were many fold the effort.

Risks in finance on the other hand are much more subtle and unless one takes risk that is multitudes of what he can afford, very rarely does one end up being killed. Yet, investors love being part of the herd than try to plot their own path.

The greatest appeal with following the herd is that if it fails, one knows that one is not to blame for everyone fell in the same ditch. In the mutual fund space, it’s not very different with most fund managers sticking to the known devil than the unknown angel.

Blind bets aren’t experiments, they are death wishes and most likely destroys not just investors’ money but also confidence. Confidence once destroyed is tough to regain. The worst thing though is that we take all the wrong lessons from a debacle that was at best just an error in strategy.

In 2017, I started my Journey on yet another strategy – a strategy I was intimately familiar with and yet one that I had ignored for too long – Momentum Investing.

I have been a fan of Trend Following / Momentum for a very long time. I have talked on the subject to anyone who gave a willing ear, have written a lot about it and delivered a few talks as well. Yet, it took a catalyst in the form of joining Capitalmind to finally be able to put it into action.

Unlike other forms of Investing, Momentum Investing can be tested rigorously using historical data. There is no narrative fallacy out here though it’s easy to get trapped into one of the many other fallacies that trap quantitative based investors.

Momentum also better known as Trend following is generally seen as Speculative in nature for stock is picked with no reference or understanding of fundamentals. But fundamentals of a company are just one part of the equation – the bigger part is played by human behavior which gets exhibited day in and day out and one responsible for the wild swings in stock prices.

Efficient Market Hypothesis was for long the most important pillar of how markets valued stocks and why it was tough to generate, adjusted for Risks, out-sized returns. While the booms and busts have meant that markets may not be really efficient, to me, they just showcase that markets are efficient in the long term but swing around in the short to medium term.

It’s these swings, Momentum Investors wish to capture. While it’s nice to think ourselves as owners of businesses just because we hold 1 share out of a Million issued by the company, the fact remains that you are just a passenger in the bus with the direction and decisions taken by a few men, the bus owners, with little regard to what you may think about those decisions. The only action you can possibly do is get off the bus – but like the proverbial picture that has been seen by millions, what if you are giving it up just before you would have hit pay dirt?

As a momentum investor, our focus is more on the behavior aspect of the markets. We would rather be part of businesses where there is action, in terms of price, than one where we need to wait a long time before the action starts – or in many a case, wherein action never starts and we quit in disgust.

On any day, on an average, around 2000 companies trade on the twin exchanges in India. As an investor, you need to build a portfolio that consists of less than 1% of the said companies.

Of course, not all are great companies run by great managements that can generate strong risk adjusted returns for the Investor. Even if we were to assume that just 20% of the companies are companies that will generate returns for the Investor, using the Pareto Principle, we are still left with 400 companies to choose 20 to 30 stocks that shall form the core of our portfolio.

Take any factor and the thesis they offer is simple – How to come up with a small list of companies to invest into. You can base it on the philosophy you follow – call yourself a Value Investor, a Growth Investor, a Quality Investor or a Momentum Investor, your aim is to prune down the list to the best 20 – 30 companies.

It’s tough to do that would be a massive understatement. Assuming a portfolio of 30 stocks, for every company you choose, you are in affect ignoring the potential in 29 companies and some of those you ignore will generally come to bite you back by showcasing returns way better than the one you have chosen.

In other words, you need to reject 98 to 99% of companies whose shares are available for trading and invest in the 1% you feel are the best ones around.

But the Nightmare doesn’t end with the Selection of Stocks. In fact, it has only just begun for what would be a real roller coaster of a ride if only you are able to sit through the same.

Once you have selected a stock, the next big question comes in terms of “How much to Invest”. Invest too much and you could be burned brutally for the trouble, Invest too little and even the best of picks will not move the needle by much.

Investing is nothing like, Fill it, Shut it, Forget it. To maintain a balance, you need to keep filling it up as you move along your life trajectory while at the same time being able to shut yourself to the volatility that shall always be part and parcel of your investment.

Strategy and Tactics:

The thought process behind the selection of stocks was simple. Identity stocks which gained in price without volatility or rather, had very low volatility in relative comparison. In other words, the stocks picked-up had the highest Sharpe Ratio.

Strategies in Momentum needn’t be complex requiring use of Calculus or any other the other mundane mathematics most of us felt relieved when it ended post School. While this strategy does require some calculation, it’s not really complex given the resources that are available on the Internet.

The strategy was initially tested by my good friend and colleague Venkatesh and was further refined over time with the help of my Mentor Sameer. While markets are yet to encounter the kind of volatility we saw in 2008, I believe that the knowledge of how the strategy works and where it can fail alone can help an investor (in this case me) be better prepared and act on the plan without having to deviate.

The strategy was run on NSE Stocks (most good liquid stocks are on NSE and the few that are part of BSE alone, I am happy to miss out) with every month seeing a few stocks getting replaced. Other than once or twice, more due to accident than a plan, the strategy was always fully invested into the market at all times.

I started this strategy in May of 2017 and since then regularly added more money every month at the time of rebalance. For someone who isn’t a great believer in blind systematic investing, this was indeed a interesting excercise.

The strategy is Equity only – there is no cash component embedded. The Equity Debt Allocation mix was dictated by the Portfolio Yoga Asset Allocator (though I am guilty of not entirely sticking with the recommended dosage).

The churn has been incredible – over the last 12 months, I have had positions in 105 stocks though at no point was the portfolio greater than 30 stocks. This excludes the fact that some stocks made an entry and exit more than once.

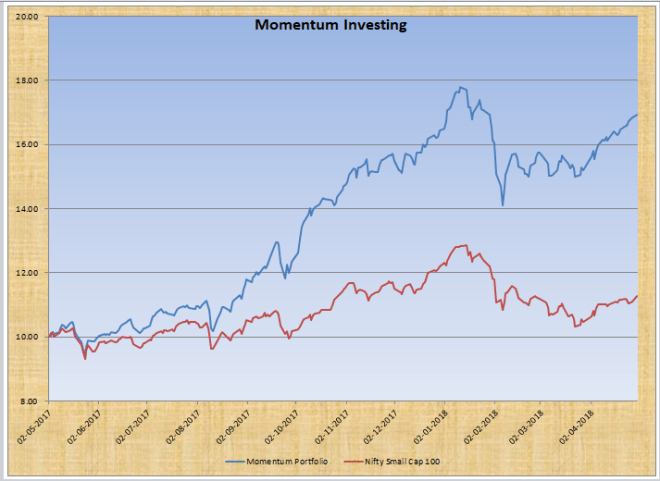

To provide a granular view of the returns, here is the data plotted as in Mutual Fund. NAV started at 10 and is currently at 16.92. Nifty Small Cap 100 Index was taken as benchmark given the high correlation this portfolio saw with the Index.

While the strategy has done wonders, one needs to be aware of the fact that “One swallow doesn’t make a summer” and it would need much more data and time to make a comprehensive case that investing in Momentum with all its pains – paying short term taxes / excessive transaction costs can still provide for returns better than what you can by buying and sitting on an Index.

Momentum Investing returns aren’t out of the world. Academic evidence shows that its returns are comparable to one you can get by following the Value Investing methodology.

Returns though come with a big “IF”. If only you actually understand can you really devote the kind of money and time to make that difference can you reap the rewards as well.

This brings an interesting question: If the strategy was sold as a Service, would investors have reaped similar returns?

Momentum or Value or Growth or any of the major styles of investing is all about being different. This doesn’t come easy for it runs contrary to our beliefs and knowledge. This kind of thinking is not tough to develop but takes time and effort.

Mutual Funds are a Fund it and Forget it type of investment and yet even there, Investors generate much lower returns as a whole that what the fund itself has generated. In Do-It-Yourself kind of investing, the resulting returns can be even worse since with execution resting on your emotions, there is no giving as to whether you would stick in the good times, forget the bad.

Risks:

While there is no fundamental filter that is applied, I have using other measures in an attempt to limit entry of stocks that are of suspicious nature. But that doesn’t meant that we can get rid of all the bad stocks as experience told me.

One of the stocks the strategy invested was Vakrangee and when the sword fell, the portfolio was a sitting duck and lost 50% on the stock before it could get an exit. The only saving grace, the Investment had doubled by the time of the peak and hence even at time of exit, the damage itself was minimal.

Since the portfolio consists of a diversified set of 30 stocks, a couple of Vakrangee while causing heart burn cannot seriously damage the returns for their total allocation would be on the lower side.

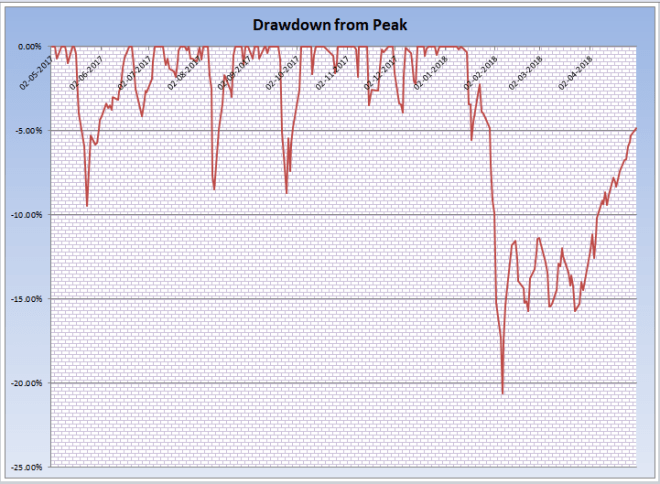

Drawdown:

Any and every strategy will have its draw-down and my belief is that this will be close to the Index it benchmarks against or a bit more.

Why others don’t do it

The fact that a factor such as Momentum Exists and can be profitable over the long run isn’t new. The first comprehensive research was put out by Jegadeesh and Titman in the year 1993 (Returns to Buying Winners and Selling Losers:Implications for Stock Market Efficiency). Unfortunately for strategies to get a following you need more than academic evidence – you need practical evidence.

Value Investing may not have got the kind of following it has if not for the performance of many a manager who follows the methodology and has cleaned out his competitors. And then there is Graham and Warren Buffett. One does wonders what would have happened if Warren was swayed by something else than Value Investing?

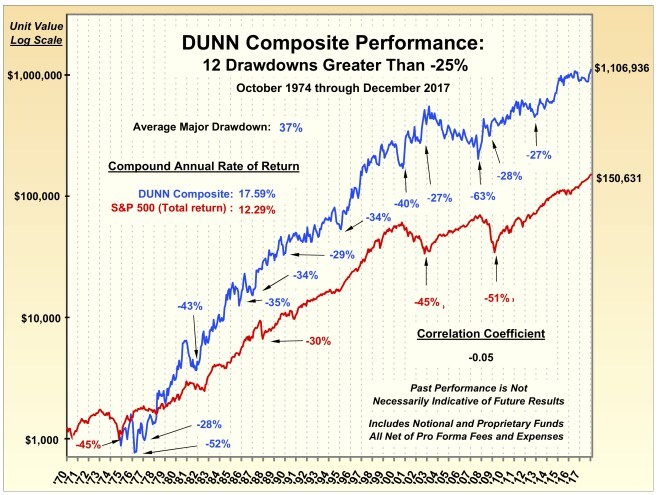

Momentum on the other hand has barely much of a following. One of the oldest funds out there following a systematic momentum strategy would be Dunn Capital. But despite being around for 44 years, its total Asset under Management is just around a Billion Dollars.

Momentum faces the same issue like Small Cap Investing – more the capital, tougher it is to generate returns similar to what historical testing would showcase. Add to it the fact that most countries tax based on duration of holding and until recently, India had zero tax if you held a stock for more than a year versus paying 15% for short term gains.

Thankfully this spread has now been reduced to just 5% with Long Term Capital Gains too being taxed from this year onwards. Tax Arbitrage is now no reason for holding a stock even when the trend has turned bearish. But without a systematic strategy, not knowing when to get back in can have an negative impact too.

While there are a lot of closet momentum investors among fund managers, but I cannot spot a single manager who will talk about Momentum being a factor in his investing arsenal. There is just a lot of negativity by those who do not really understand and lump momentum trading with everything from manipulation to intra-day trading.

A bigger fear among investors is that somehow larger churn means that there is a bigger risk. In my testing and experience, Momentum Investing carries the same risk as any other strategy – maybe even a bit more but not suicidal risks. But risk is never known beforehand – its only ex-post.

In 2008, many Balanced Mutual Funds fell very close to what the Nifty had fallen despite the whole strategy being one of risk reduction at the expense of returns. Investing is always risky – what one needs to analyse is the magnitude of risk and the probability of recovery if one stayed the course.

Momentum has one big negative though – the inability of us to provide a Narrative as to why a certain stock was picked up. No Cinderella or Alice in the Wonderland stories about how great this stock is, how big the potential is, how cool the management are, how niche the industry is and hence how big their moat is.

When the system picked up Carbon / Electrode stocks across the board, it was not because the system was able to understand the international ramifications of the war on pollution in China. Or in case of Venky’s , it was not because the system felt there would be a positive impact of the Beef ban (or was that just a story without real substance I wonder) on the price of Chicken Feed / Chickens and Eggs.

These stocks were bought because the frickking momentum formula used to identify asked us to buy – nothing more, nothing less. Similar is the story when a stock moved out – it may and very well be a good stock to hold, but with hundreds of other opportunities out there, why stick with something that isn’t working for now.

In my own trading, I had a couple of interesting such times.

The system first picked up Venky’s in the very first month – May 2017. In June, with a month gone and nothing to show, the stock was thrown under the bus.

By August, the stock had shot up, nearly doubling from where the Initial entry was made and once again came into the radar and got picked up. Buying the stock that was sold nearly 50% lower is tougher, but systems have no emotions and stocks are picked up purely based on the logic that has been coded.

Since its entry, it once again doubled showing that missing out is not the biggest of crimes, it’s not getting back in even if it’s at a higher price that can turn out to be costly.

Can the Returns be sustained?

Its feel great to beat the markets and generate strong returns, but the reality is that this is not possible to do over the long term.

As Wes Gray of Alpha Architect fame wrote

“An investor might have an epic run of 20% returns for 5, 10, maybe even 15, or 20 years, but as an investor’s capital base grows exponentially, the capital base slowly becomes ALL capital, and all capital cannot outperform itself!”

Styles and Allocation

Momentum is a great strategy and one that can absorb quite a sum of money, but great rewards come with risks that one may or may not be able to digest.

For a while I have been having discussions and thoughts about how much of one’s equity exposure should go to Momentum. Is 100% too large or is 10% too small is a question to which I have absolutely no real answer, I think the real answer like a lot of stuff in life lies in the middle.

As much as each one of us would like to maximize our returns, the fact is that when it comes to crunch situations, we do not really know how we shall behave.

Momentum is one of the many Styles of Investing that has shown to generate Alpha. More styles would mean more work, but since most styles differ and offer very little correlation to each other, in the end, they offer you the ability to invest more in the markets than what an asset allocation matrix would dictate and yet sleep peacefully at night.

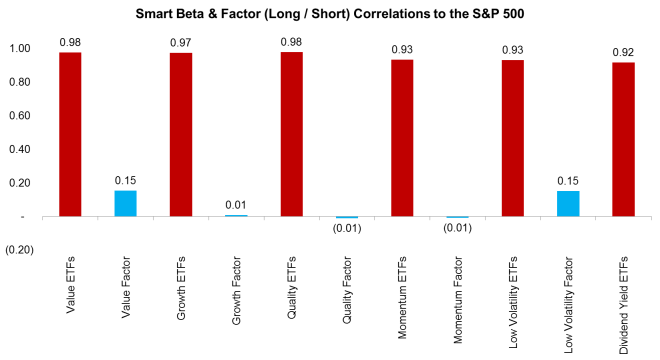

As the above data table from factor research shows, each factor has very little correlation with the others and if you can build three to four different portfolio’s, each confirming to one style, you should be able to get a good night sleep and a pretty decent return despite your portfolio consisting of a 100 different stocks.

In their book, Your Complete Guide to Factor-Based Investing: The Way Smart Money Invests Today by Andrew L. Berkin & Larry E. Swedroe, they recommend an Equal Weighted portfolio of 4 factors – total stock market (for beta), size, value, and momentum.

While this can reduce returns, it reduces risk while diversifying portfolio across multiple stocks which ensures that a fraud or a scam in one stock has barely any impact on total returns. Diversification is not a free lunch for concentrated positions can clearly provide higher returns – but the risk as Bill Ackman found in Valeant Pharmaceuticals can be very high too.

At the moment Momentum Investing is a Do it Yourself program. But in the future, there will be funds which will deploy based on philosophies other than just Value which is the dominant style of investing today. Its just a matter of time as more Academic evidence piles up showing the benefits of having Momentum as part of your portfolio.

Good article. I am trying out a strategy which picks up stocks which has out performed bond returns in four time frames. Previously I had a value investing but with stocks having better relative performance

Thanks! Let us know what other kinds of information you’d like to see and we’ll try to add it in the future. Best of luck!