Unless you have been sleeping under the rock for the last few days, you would have come across multiple posts on GameCorp, a company that may have been way less known in its home country at the beginning of the year but one that is now known and analyzed throughout the world.

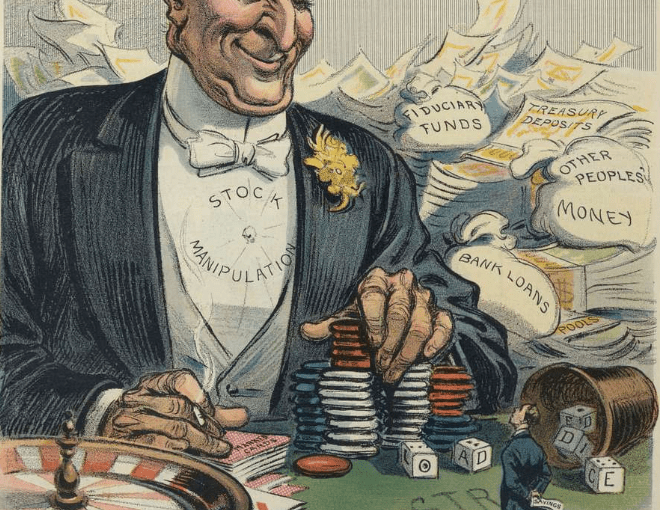

Market Manipulation is as old as the woods. While I am sure the markets were manipulated by select coterie even before the 1700’s, this small video makes for a nice intro into market manipulation and price rigging that was seen 300 years earlier.

Warren Buffett made his money the slow way. Compounding after all doesn’t really break the bank in a year or less. For many though, this is way too slow to their liking and would rather be pleased if they can multiply their money at a much faster pace.

One of the easiest ways to move the price higher is to corner the commodity or stock and make it harder to get. The less floating stock available, the faster it shoots up and the faster it shoots up, more the interest by others wanting to jump into the action.

The biggest issue that most speculators face when they attempt to corner a stock is that they aren’t rich enough to buy out all the stock and hence resort to leverage and all that results is a house of cards. One whiff of wind is enough to bring the biggest of them down to the ground.

One of the most audacious attempts to corner was attempted by Jay Gould who attempted to jack up the price of Gold by cornering as much as possible both directly and indirectly via ensuring no flow from the Federal Reserve (Link). While he was successful, a similar attempt by the Hunt brothers to corner Silver failed. Some other notable attempts (link)

Who doesn’t want to jack up prices. Industries try to do this constantly by engaging with their competitors and try to push up the prices even if demand has not shot up. Engaging in such actions is seen as fraud and when caught companies can be penalized. A example that comes to mind – CCI fines cement companies $944 million for price fixing

Cornering stock in India ain’t easy. As soon as your holding crosses the 5% mark, you are supposed to intimate the company and continue to intimate them of any changes. If you cross 26%, you need to make an open offer to other shareholders.

This is when a single person is buying up the shares. But what if a host of unconnected persons buy shares to move up the price as has happened in GME? Actions such as those have no history – manipulations of price have always been by people who are known to each other in some way and have built a trust that enables them to field their money to the venture.

While it’s exciting to watch the action from the sidelines, anyone who has seen the past knows for sure that these things won’t end well. Hedge funds do make mistakes but their size and ability to cut the losses (as we gave seen with GME) is vastly different from the action of retail investors who get anchored to the high prices and generally are less willing to take action when the trend goes against them.

This boom is actually positive for companies who have a viable business but are indebted by debt. Like in case of Hertz (though it failed since it was already in receivership), it’s easy for the company to actually come out and issue new shares at these crazy valuations and no matter how many fearless investors there are, a hoze of new issues will quickly temper the spike and later turn into a orgy as everyone tries to exit at once.

While such actions aren’t possible in India due to very few stocks having any decent short positions in the first place, it has been seen hundreds of times in stocks that have had a very low float and have been ramped up.

While Ruchi Soya comes to mind, check out MMTC in the past. Small float is easy to corner and if you have the management on your side, you can ride your way to glory. Of course, the problem though is that after riding the tiger, everyone wants to get out of one without being eaten and is generally tough unless enough PR has been built via various media channels to make retail get excited.

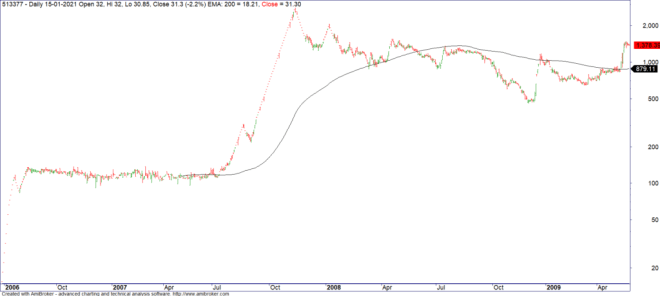

Take a look at the MMTC chart below {Chart adjusted for Bonus and Split}

The interesting data point of the whole rally from 300 to 56,930 was achieved with volumes of just around 31K thousand shares being delivered.

While the stock fell off sharply from the peak, the real distribution started when the company issued a Bonus and the stock face value was split from 10 to 1 in 2010. Volumes exploded and after more than a decade, investors are yet to see the prices anywhere close to where they were in 2010 / 2011.

It’s easy to get caught in hype around a company with the stock booming higher. Who doesn’t want to participate. But like Vakrangee taught me, getting in is easy, its getting out that is the key and where most of us make the mistake of believing something we knew not to be true to be true.

Compared to the antics of the Wallstreetbets, manipulation in India is much more rampant with stocks gaining 1000% or more in a year with very little activity. Bafna Pharma went up recently from Rs.5 to Rs.170 without a single day of normal trading activity. Tanla merits a mention too though the path was more staggered here.

I participated in the Dot com bubble and what I see in US markets is reminiscent of those times. The story backing it up was different in that time, but the stock moves were very similar if not more exaggerated (then vs now). For Nasdaq to reclaim the peak took 15 years though far fewer companies survived the same.

The narrative that is currently being thrown around is Liquidity though we saw the Dot Com bubble without any similar kind of liquidity. It finally falls to behavior – especially Fear of Missing out that explains the actions of people who were seemingly sane one day and on another went out and bet all their life savings on things they had very little understanding about.

Finally do remember, we the Retail are the weak hands. This doesn’t change even if we are able to score a few goals here and there. In the long run, markets are efficient and strong hands always win. Investing is not a game even though it evidently feels like one.

Image Credit Power Grab: Activists, Shorts & The Masses — Investor Amnesia

Sir, that’s it.. The next factor is ‘meme’ntum investing!

And a new ratio: the price-to-memes ratio 🙂