Today morning, good friend and guide, Sunil Arora tweeted the following

The only way to make money in the markets is Long term investing. have no doubt about that. I have now completed 31 years in the markets

— Sunil Arora (@moneybloke) June 30, 2015

On the face of it, that statement makes complete sense in every regard. There is tremendous evidence that traders end up losing their capital within a short span of time. In fact, evidence from brokerage points out that 95 to 99 percent of all traders end up either having wiped out their capital or at best generated returns that aren’t commensurate to the amount of time and energy spent on achieving the same. While there is no such static with regard to investors, I wonder how many really thrive – in sense, how many actually are able to generate healthy returns for the efforts put in as compared to what could have been achieved by just buying a Index ETF and sitting on the same. Its tough to measure success / failure for investors due to various reasons including but not limited to fact that there is a lot of Survivor bias and Sunk cost fallacy at work. Investor buys stocks like Koutons (which today we know is bad, but as I pointed out in one of my earlier blog posts was recommended as a fine stock by major brokerage houses) and if he had just sat on it, it would still be on his demat account even though trading has long stopped. If one has caught onto the right stock and sat on it, the returns would be fabulous indeed. But once again,as I wrote in my previous blog post, its the Quantum of profit that becomes important than just percentage since unless the bet was fairly large, even a 100x return can be meaningless in today’s money. The biggest difference between a trader and a investor is the time required to get a feed back. A investor generally has a large amount of time before the feed back is received as to whether his logic was proved right or wrong. A trader on the other hand has a much faster feedback loop with he knowing within a very short span of time how good or bad his decision was. A secondary difference between a trader and a investor is the use of leverage. While a trader loves to leverage his capital in the hope of capitalizing more gains, a long term investor can rarely leverage and hence can invest only as much as his capital would allow him to. The biggest advantage of not using leverage for a investor is that he knows that the only way his capital can go to zero is if all his picks go to zero. A trader on the other hand can get chopped out even though the markets may have moved nowhere. For example, just today, ReformedBroker posted this tweet

If you’ve been buying and selling the S&P 500 this year on every 50-day moving average cross, you’ve traded 27 times pic.twitter.com/HtmpVx6N2l — Downtown Josh Brown (@ReformedBroker) June 30, 2015

If some one had traded every signal with a fixed position size, he would have run out of capital long before we hit this 27 mark. Of course, even a guy who uses position sizing would get killed (not to mention lose his hair trying to stick to his system) if he followed the same blindly.

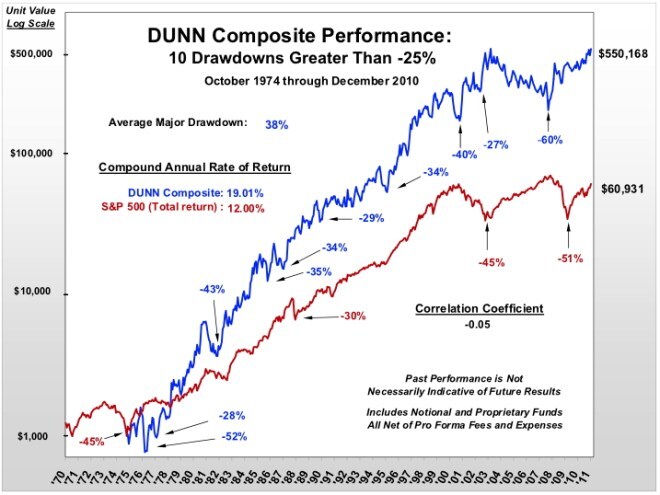

Then again, if trading was not a feasible way to generate profits, could we see the kind of returns that Dunn Capital Management has generated using purely trend following systems?

While the fund goes through gut wrenching draw-downs that have in some cases gone on for years together, the end result has been one where the program has strongly beaten the markets (as measured by S&P 500). In fact, if you were to search the CTA world, you would find many such examples, though Dunn as far as I can see is the one with the longest track record.

Long term investing does not mean easy money as Sunil tweeted in his tweetstorm

If someone thinks making money is easy in the stock markets, think again. It takes real hard work and then some

— Sunil Arora (@moneybloke) June 30, 2015

Earning a profit higher than what the markets provide (again, as measured by the benchmark) is neither easy nor possible for a large number of investors.

In fact, I strongly believe that majority of the investing population out there neither has the capability nor the band-width required to be a investor / trader and are better off achieving their goals by prudent investing in Mutual Funds / ETF’s.

For every one stock that has given abnormal returns in the long term, I am sure one can easily find 5, if not 10 stocks that seemed to make even more sense at that point as a great investment just to be wiped out in time.

Every market peak has seen hundreds of stocks making the news and every bust has seen most of them wiped out. The few survivors that are left are those that could pass through some of the booms and busts and yet survive. In the 2000 IT boom, at Bangalore Stock Exchange, we had around 50 stocks that got traded. Of them, I wonder if even a dozen survived (forget about thriving since many of them are yet to see their highs of 2000, 15 years later).

I am all for the long term if you are willing to work hard at identifying opportunities that get presented by the markets and are willing to wait for long time frame to pounce only when a opportunity presents itself. Else, your long term is better off as a investor in Mutual Funds / ETF’s which enable you to more or less achieve what the markets provide without you having to sacrifice personal and family time in an attempt to beat the market and grow your capital.

List of Companies that have got delisted over time is available here (Link). The list of companies that have got delisted either due to Compulsory Action (many a time for not adhering to listing requirements) and due to winding up of the company is fairly large.

Thanks for this.based on the above chart one can notice many draw downs in TS compared to benchmark. I am sure about how much leverage has taken in this TS.IMHO the volatility in equity curve would be high if how take high leverage. one can also observe that first 5 years the trading system not generated any return. I am not sure about whether expenses considered in this case. moreover for trading one need to pay short term capital tax where as long term investment enjoys tax benefit.

Another important issue in trading is how long one can continue with that system ? since it requires day to day activities.if he misses some trades due unavoidable circumstances then results would based on luck.

An Investor has enough time to manage draw downs during bear phase. this advantage a trader does not have.

FA and macro economic analyses can provide an edge for investor. whereas for trader optimization in parameters will give some edge

Also one can invest his entire wealth in long term. whereas if one put his entire wealth in trading system Just imagine

situations like last monday. even though trading has better rate of return I am very much doubt about how it can be use full for wealth creation

for investors one can use margin of safety. while for trader he should be ready to face even double times bigger draw down of largest draw down which happened. (biggest draw down yet to come 🙂