Today I read a tweet by a person who claimed that he was posting his ledger just to showcase to those who believed that “Day traders loose” that its indeed possible to make good money trading purely on intra-day scale. While I have not met him, I do take his word on faith and assume that he is indeed pretty successful in trading the markets on pure intra-day basis. And there is this friend of mine who has build a fortune (by his standards, not Fortune’s) by just being street mark and networking with the right folks.

In November of this year, a 4 year kid fell 230 feet and survived (Link). Lots of people make money in Casino’s as well despite the known fact that “the house always wins”. And this without having to do card counting.

I know plenty of long term investors who have not been able to out-perform a simple Buy & Hold returns of Nifty and even worse, many have fallen by the way side having lost a major part of the money in stocks that today are no longer even available for trading.

Vastu / Astrology are seen as bunkum, but I can show you guys whose careers have changed because of a change in the direction of the door. And there are enough people who strongly believe that homeopathy can cure a lot of diseases.

The single thread between all of them is that they are all exceptions to the rule. If no one ever made money (in short term if not over years) trading on intra-day scale, people would never try to do such stuff. And if no one won in a casino, they would have to shutter for lack of clients.

But exception to the rule does not mean that its easy for others as well. If day trading was really easy, I would doubt anyone would want to work anywhere else when you can literally make mind-boggling returns on capital (Day trading requiring very little capital is the biggest attraction).

If access to news / information ensured a success in markets, the richest folks would be those who have the first access (think of people working at Newspapers, Television studios).

If all our problems can be solved by simply changing the direction of the door, well, you should have seen that happen long back and by now we would be living in a state of Nirvana.

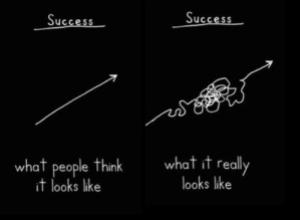

Beating the market is very tough and very few people are able to do that consistently year after year. There is no magic wand that can let you make tons of money without you having some amount of expertise. And the guys who have achieved that success, its not due to luck but more due to hard work and persistence. If you were to read about Sachin Tendulkar or Tiger Woods, the common thread between these guys were the fact that they were not only in the right place at the right time but also that they put efforts more than what others did and as Robert Frost would say, that made all the difference.

Excellent post. Many good points around a simple yet valuable truth.

I have been investing for over 30 years and I have seen many stock market experts raise and fall.

Warren Buffet owns IBM and Exon. Two very bad investments in 2014, even the so called best get it wrong.

True that.

Very Valuable post .

Lots of insight , Thank You.

Totally agree ,even if people know that the best strategy is to buy index ,very few do it ,any insights

The reasoning is simple. When you buy a Index ETF, you are in a way also agreeing to the logic that the probability of beating the markets on a long term is thin. Also one needs to agree with the thought process that we do not have control over the future.

But most us do not think in that way. We feel the need to have some control & that compels us to chase what is currently the hot performing fund / stock / sector just in time to see that hotness fade away.

Somethings never change 🙁

Is it related to Psycho/Behavioural.