Google’s top Search Prediction for “Stock Brokers are” is Scum. That is not too surprising either given how many have been ruined by brokers eager to make their dough. While things have improved a lot, even today one keeps hearing about scams run by brokers either with the knowledge and tactical approval (as long as it seems working) of the client or skim them off without their knowing. Anugrah Stock and Broking & Karvy come to mind as big ones in recent times.

Sales is the cornerstone that defines success or failure for any product and company. If you buy a bad product in the normal world other than finance, the damage is limited to the amount you have spent. Buying a wrong financial product has implications beyond just your investment for they also create a narrative which is tough to counteract with.

Trading for example has been repeatedly shown as something that won’t make you rich or wealthy and yet the income for most brokers is driven by investors who are these days fighting the machines and if Kasparov could not beat Deep Blue way back in 1997, I wonder how much of a chance most traders have these days.

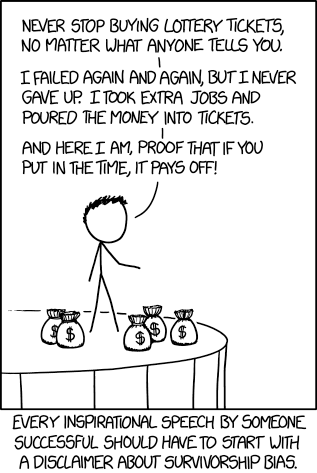

As a broker I was able to get a ringside view of the world of traders and I doubt I have come across a single successful trader who won regularly and consistently. Of course, on Twitter I now come to know that trading is as easy as ABC. While brokers I assume even today entice clients with the riches they could bekon my trading, trainers and advisors I assume are the real guys making the moolah.

Trading for a Living (which is what most want to do in life) is what most people dream about while having a capital that is fit for trading at best on the monopoly game board. I am pretty sure there are wonderful successful traders who make a good living by trading, but it has the same odds as the guy who won 1 Crore on Kaun Banega Crorepati.

Trading is addictive in nature regardless of whether you made a profit or not. I remember reading somewhere that the average time frame a trader survives in the market is 6 months.I guess the data is wrong for I know of unsuccessful traders who have survived the markets showing its displeasure for years.

Like a drunkard who cannot but stop by the bar every day after work, so are some of these traders who are successful elsewhere but decide that it’s in their destiny to win the battle of the wits.

Before the arrival of Futures & Options on our exchanges, fortunes were made and lost by traders but the number of traders were fairly limited given the limitations exchanges of those days had. Technology and Futures and optiosn today on the other hand provide an easy way to take exposure greater than one’s net worth on nothing more than just a whim.

The odds of success being so low, it has always fallen upon the brokers and advisors to take up cudgels on behalf of the successful trader who is mostly seen missing in the woods so as to speak. How dare you point out the low odds of success here, don’t you know that 9 out of 10 businesses fail in the long run and yet there is no end to a new set of entrepreneurs who wish to do something different. On twitter, such a riposte would be seen as “whataboutery”.

Jack D. Schwager has in time written a few books in the Market Wizards (his latest book is out by the way – Unknown Market Wizards ). His previous books are worth reading and hence reading these should be fun. There are a few evergreens featured in his earlier books Bruce Kovner, Paul Tudor Jones, Ed Seykota, Michael Steinhardt, William O’Neill, and Richard Dennis who continue to command attention even today. What about the rest of the guys though – googling a lot of them ain’t easy but some of them did make news (not of the good variety though).

Nothing can be tarred and so is the world of trading. Even if we have just 5% of traders who are the real outliers, we are looking at a few thousands if not lakhs of them. Who doesn’t want to be that 5% and yet the 95% who fall by the wayside have a different story to tell altogether.

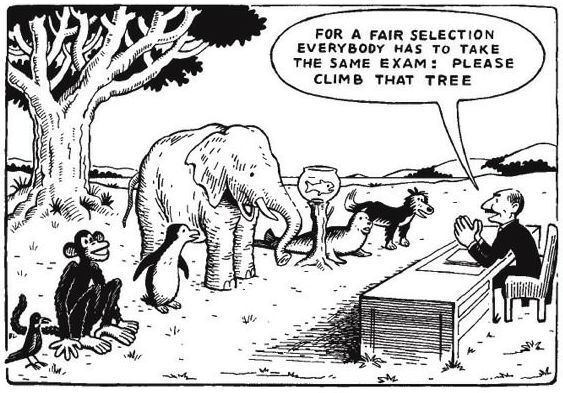

Investing is tough too. Just look at the number of fund managers with degrees more than you can count and deep research scholars secured at a pretty expense trying and failing miserably to beat a simple system that is the Index.

But on the other hand, if you remove the unfairness of that comparison which to me kind of reminds me of this cartoon

what is actually true is that in the long term most funds actually end up making money (even if lesser than the Index). Of course, many funds don’t survive so long because investors always want the next best thing, not something that seems to have tripped on its own shoelaces.

One of our family’s earliest mutual fund investments was made around 25 years ago. This fund was not the best for a long time (it was under par if my memory serves me right for the first few years since its NFO) and yet over time it has delivered around 14% CAGR. Over time the fund has changed its name and even the nomenclature but in the long term, its returns that count and its delivered.

I like to make fun of Venture Capitalists as Philanthropists but the true Philanthropists are the traders many of whom are willing to burn their own home for the ability to light the home of the broker.

As my good friend Sriram likes to say, there are old traders and there are bold traders but there are no old and bold traders.

The Title of this post comes from an Ed Seykota saying –

“Win or lose, everybody gets what they want out of the market. Some people seem to like to lose, so they win by losing money.