One of the rational behind trading systems is to ensure that we are able to capture as much of the return as possible without having to go through a draw-down similar to what a Buy & Hold strategy would entail. This is achieved by being exposed to the market for as less a duration as possible.

One of the strategies which I stumble quite often is the strategy of the First day. The concept here is simple enough – Buy at close on the last day of the month and sell on close on the first day of the month (both trading days and not calendar).

I tested that idea for CNX Nifty (Spot) and while we are exposed just 1 day (out of average 20 trading in a month), we are able to capture 26% of the total move that happened in the interim period. For a strategy that has no major rationale behind it, this number is pretty awesome.

The testing period was between 1st Jan 1996 to 1st April 2015. The expectancy of the system comes in at 8.62. The system has 141 Winners and 90 losers. Average win is 38.04 points vs a Average loss of 37.39 points

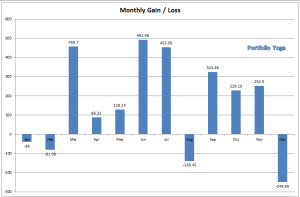

A interesting point to note is the fact that not all months are the same in terms of profit potential (or at least, that has been the case historically speaking). June, March and July are the best months for the strategy while December, August and February turn out to be pretty bad months.

To get a better understanding, here is the chart showcasing month-wise break up of the return.

If one were to ignore months that were not in our favor, the odds increase even further. But then again, unless we have a clue as to why some months are better than the others, treating all months as the same would be the best way to trade strategies such as these.

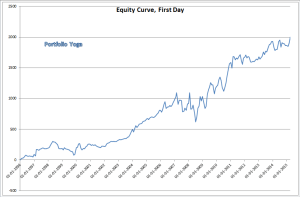

The Equity Curve (points) generated by the system shows no major hiccups other than in 2008 when it saw quite a bit of volatility.

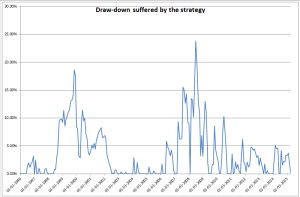

To get a better sense of the risk, here is the chart of the draw-down it would have faced.

The period between 2003 and 2007 was when it had the best performance with the equity more or less hitting a new peak every month or so. 2000 and 2008 were times when even the most disciplined trader who traded this strategy would have been shaken off by the incessant losses. Post 2009, while markets have been on a consistent rise, the strategy has had quite a few setbacks with one seeing multiple instances of 5% draw-downs.

The fact that this strategy has generated just 282 points from September 2011 till date shows that maybe, just maybe the strategy is getting out of favor with the rewards not worth the risk it entails.

But before we dump this strategy, lets run a Bootsrap on the returns to see whether the returns out here are due to pure luck or is there something more.

The p-value one gets is 0.55. For anyone who was not put off by the high draw-down one saw earlier, this should definitely be a deal breaker. Then again, the lack of any substantial profit over the last 43 months in itself says that the markets may have changed and this strategy no longer works as it did in a earlier time.

On a side note, it seems that this strategy has been under-performing since 2011 even on $SPY. Food for thought I think on how global markets may have become.

Is it same in Nifty future, as often we loose premium on very first day.