The big news today is that Groww is acquiring the Mutual Fund business of India Bulls. A few days back, NJ India got SEBI in-principle approval for their Mutual Fund License. Another 7 applications are queued up at SEBI.

There was a time in the past when everyone wanted to become a Stock Broker. I think I myself was influenced by those times because despite not understanding the business, I aspired to become one.

In 1996, the BSE Membership Card made an all time high of 4.11 Crore when a defaulters Membership card was auctioned off. This is a record that will stand in time. Today, you can become a member of the BSE by depositing a comparatively lower amount and one that is actually refundable.

While the Indian Mutual fund revolution started nearly 30 years back with the entry of private sectors to a sector that till then was the exclusive domain of UTI, the number of funds have stayed more or less stagnant for a long time.

This won’t be the case any longer though with SEBI revising rules that allow for the ability to start a Mutual Fund and one that has attracted a lot of new participants. My guess is that by the end of this decade, we should be having more than 100 Mutual Fund houses.

Starting a Portfolio Management Service (also called PMS) today calls for a minimum financial commitment of 6 Crores at the start. The business becomes worthwhile once you cross the magic 100 Crore in Assets.

Mutual Funds on the other hand require (based on the kind of application they are submitting) anything between 60 to 110 Crores. I would guess that with no profit sharing option unlike PMS, the breakeven will be way above 1000 Crores in Assets.

Players who are small and unable to get to that kind of assets will either have to be subsidized for a long time by their investors or will sell out to stronger players like what has happened with IndiaBulls.

The key to getting to breakeven territory is two fold – performance and distribution strength. Remember that even today 80% of the mutual fund flows come through distributors and while performance can help, as we have seen in the case of Quantum (when it was one of the best performers), without distribution, it’s hard to scale.

So, why the rush you may ask.

Being a broker in the past meant being part of an exclusive club. Even today, there are just a few thousand brokers for a country of a Billion+. Getting to become a PMS means an even exclusive club that has just around 250+ members. Mutual Fund is the cream in that sense – you are right at the top of the food chain.

What helps also is the fact that the interest in equity is slowly growing and the percentage of savings that go into equity today is very low. So, there is huge growth opportunity that is available for those who are able to capture the trends

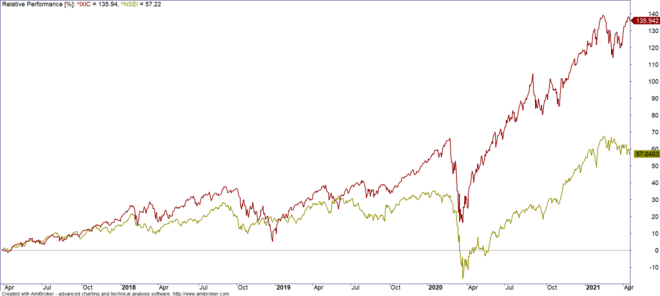

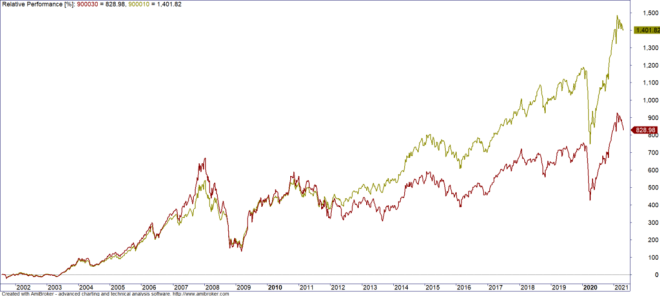

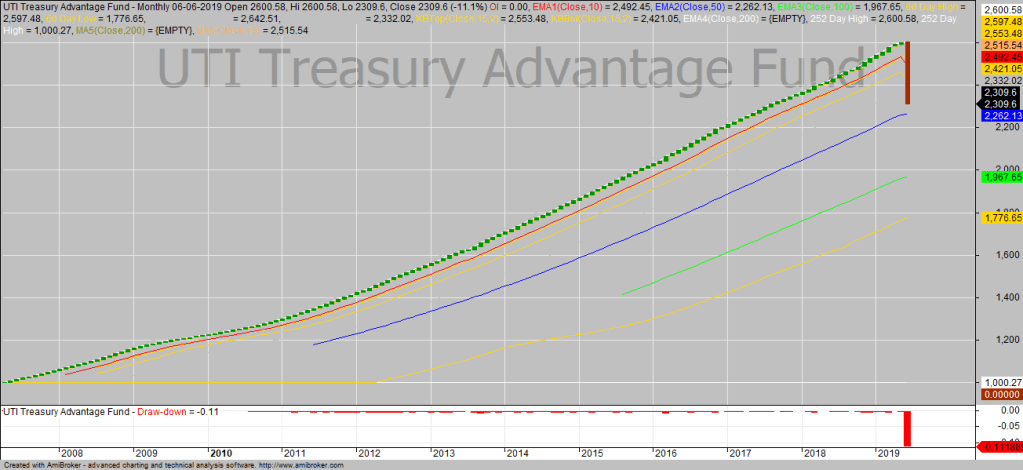

The biggest advantage for Mutual Funds is that they allow their investors to compound their money for a longer period of time without having to pay taxes for the gains that are booked inside the fund. Given that generating Alpha is so tough, this really adds value when you are looking at a very long term time horizon.

From the Investors point of view, more may be better when it comes to Fees. Right now, Fees have dropped not because Mutual funds were generous but because it came ordained from the Regulator. More competition would hopefully lead to an even lower fee structure than what we see today.