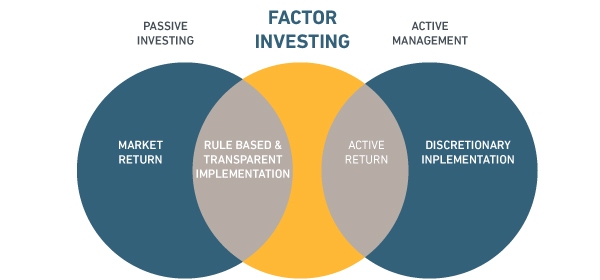

In the world of Momentum Investing, our belief is that the probability of past winners continuing to be a winner in the future is high. In some ways, this is the same logic of Growth Investing (which is not a factor based strategy as such). Here instead of looking at price, the idea is to look at the business and try to figure out if the past growth can continue into the future.

Compared to Momentum Investing, Growth (at a fair value for Buffett fans) Investing is something that allows a much larger capital to be deployed since the average holding time is measured in years vs months for Momentum.

But this is true across the financial spectrum. Angel Investing can be hugely beneficial if you strike it big, Angel investor Garry Tan for instance invested $300,000 into Coinbase and one which was worth $2.4 billion at its listing. Forget even bothering to calculate the CAGR

But Angel Investing is not dominated by big money but by small Individual actors who are willing to risk their personal money (not other people’s money) on ventures they feel holds promise. Big money on the other hand is attracted to PE funds which come into play at a much later time frame in the company and at a much higher valuation.

In many ways Momentum Investing I think can be compared with Micro Cap Investing. Once again, Microcap investing is a do-it-yourself model with investors investing in companies that have very little or no coverage at all. Most small cap funds don’t go below 5000 Crores in Market Cap while there are 1700+ companies that are having a market cap of 1000 Crores or less and are profitable.

Momentum in recent times has attracted superlative interest thanks to the strong returns that have been generated. But this is not really out of the ordinary. As the saying goes, every dog has its day so is the same with factors.

Nothing comes easy. Not Momentum, Not Value, Not Quality and Not Micro Caps. But each of them have made people rich (mostly those who have managed funds for others but also a few investors who have stuck to the thesis).

Recently there has been extreme clamour for DIY momentum portfolios. With the ability to execute with just a single click, this has made it easy for even those with no understanding of markets let alone factors to try and ride the trend.

Fascinating years for most markets are generally followed by dull years when the markets tend to go nowhere and the only thing you can do is stick to the strategy and hope for the best. From my own Momentum Backest for instance, the high of 2008 was broken by the strategy only in 2014. How many will have the willpower to go through such a long period of literally Zero returns I wonder.

The returns from investing in Mutual funds for the same period would not have been any different but at least you had no decision or action to execute every week or month. Yet, Mutual Funds on a whole saw outflow of funds from 2008 to 2013 (cumulative). The outcome for the investor in essence will not be based on the strategy but his own behavior and how he would be able to overcome the same during the tough times.

Concentration or Diversification – the age old question

“There is one other rule you ought to keep in mind and that is to concentrate, and not only in the Zen sense. Sweet are the uses of diversity, but only if you want to end up in the middle of an average.” Adam Smith, The Money Game

Other than in my early years, I have for most part been a concentrated investor / trader. For a long time, my only positions were in Nifty (leveraged). Concentration I firmly believe is the key to wealth but as it happened in my own case, the risk is that if it doesn’t work out, you are doomed to failure.

While not all great investors of time have been concentrated investors, they have whenever opportunity came forth for a great trade were willing to go way beyond what they would generally be comfortable with.

Check out this article on famed “Value Investor” Bill Miller for instance

While investors get to make a lot of noise when Rakesh Jhunjunwala picks up stocks, 50% of his portfolio is just Titan. I on the other hand get antsy when a stock in my portfolio breaches the 6% mark.

In the world of Portfolio Management Services (something I try to track closely), most portfolio managers believe in concentration with portfolio size being around 20 stocks. There are of course outliers on both sides. From a 5 stock portfolio to a 50+ stock portfolio.

I don’t know how many clients of PMS firms have become rich thanks to the astute investments by the fund manager but the biggest gainer generally happens to be the fund manager. This is because of two reasons

One: Most PMS firms have a performance fee (in addition or in lieu to management fee). What this does is provide for the fund manager kind of leverage that most of us cannot fathom.

As an example, think of a fund manager who has 1 Crore of his own funds invested into his own fund which also happens to have 100 Crore of Client money. Assume a 10% performance fee. In a year like the one just gone by (FY 2020-21) where the Index itself doubled (nearly), the performance fee would be 10 Crores.

While his own investment too would have yielded him a Crore of Rupees in Profit, it’s the Performance Fee that takes his own return to one that is 10 times others. It’s as good as if he had taken a 10 Crore Position using his 1 Crore as Capital (10x Leverage). Bill Hwang, the ill famed fund manager was leveraged 5 times on his capital but unlike with management of other people’s money, the downside belonged to him only (and hence his meltdown of sorts)

While the first reason is the one most advisors would want to become a fund manager but something outside the scope of most of us, the Second reason is what we as investors can coattail.

Two: Most fund managers have total skin in the game. Most of them have much of their net worth invested in the same stocks / portfolio that they are advising to clients. This is real concentration – concentration in a single strategy / fund. The risk is of course if the fund manager doesn’t perform (in which case the question that needs to be asked is, why is he managing other people’s money).

If the objective is to try and achieve a return of around 18%, this cannot be achieved by investing across PMS / Mutual Funds / Advisory Portfolio’s. If the objective is to achieve a return of around 12%, you don’t need anything other than a simple Index Fund that tracks the Nifty 50. A mix would hopefully provide a return that comes close to the middle – 15%.

My own objective is to achieve the best returns possible. Risk as I have come to understand is part and parcel regardless of the methodology or factor or strategy you invest into. As long as you can keep behavior under control, you should be fine.

When I started my Journey into the world of Momentum Investing, I had no real goals as such other than wanting to be invested in a strategy that gave me confidence both during the good times and the bad. 4 Years later, I think the conviction if anything has only grown.

Some Numbers:

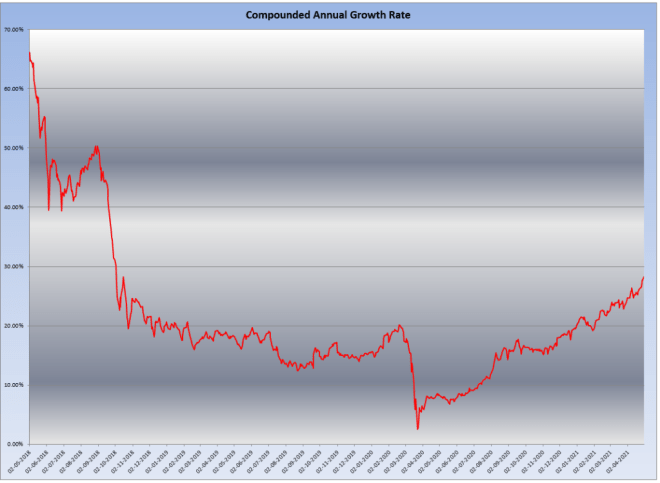

Compounded Annual Growth Rate since Inception stands at 28.21%. This is way too high and not possible to continue for long.

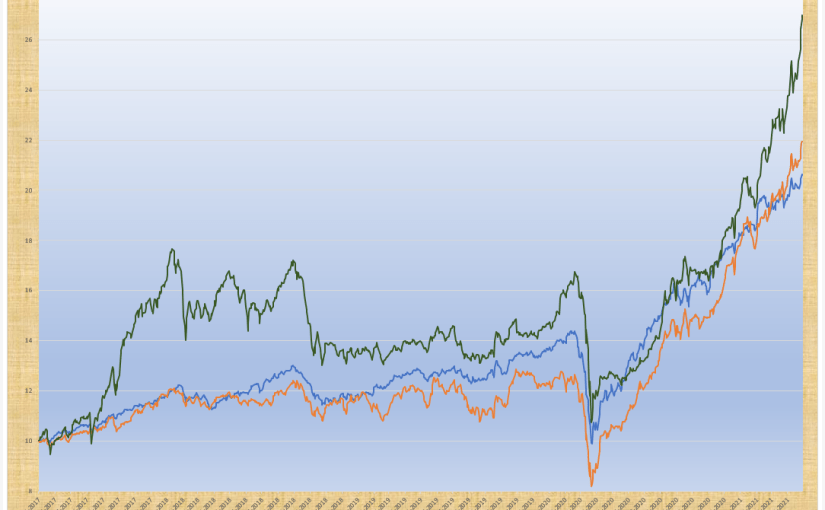

NAV with Benchmark: There are essentially two benchmarks I use.

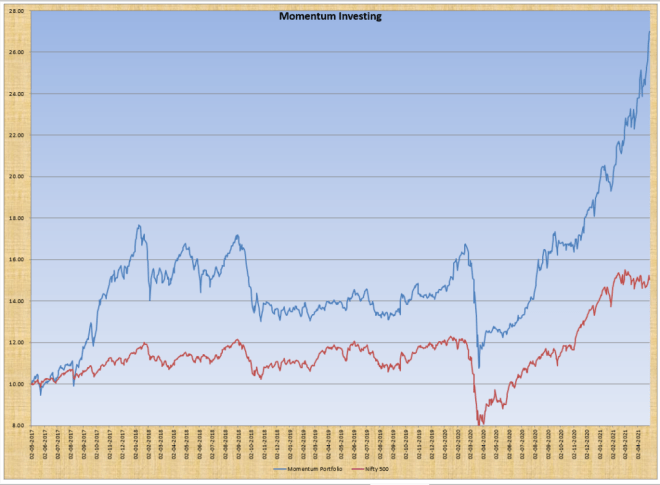

Nifty 500 for comparison with a passive market Index.

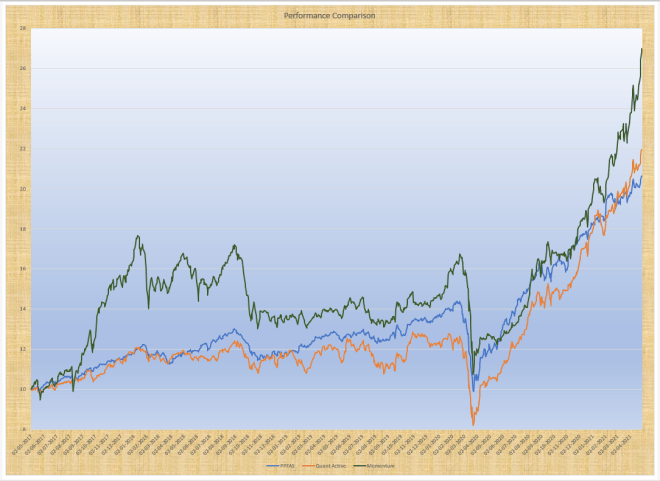

Second is to seek to beat the best Mutual Fund performance for the same period (my Inception to date). Since this is forward looking, the Mutual Funds generally keep changing over time. Last year it was Axis Bluechip Fund while this year it was Parag Parikh Flexicap Fund (if I used the filter for only Flexicap funds) or Quant Active Fund.

Since the Investment was not a lumpsum but added over time, XIRR is a way to compare with a passive benchmark which can be invested into. I used Nifty Next 50 since in 2017 when I started this, that was the hot index everyone was recommending to invest into

If you were to observe, you can see that outperformance has been strong at times and other times the performance is more or less equal to that of the fund. I was checking for a longer period (using the back-test data) and saw the same happen over and over again.

What this showcases I feel is that while Momentum can provide for strong out-performance in the long run, this can only be achieved if you were also willing to stay through the periods when the returns are either in line or sub-par.

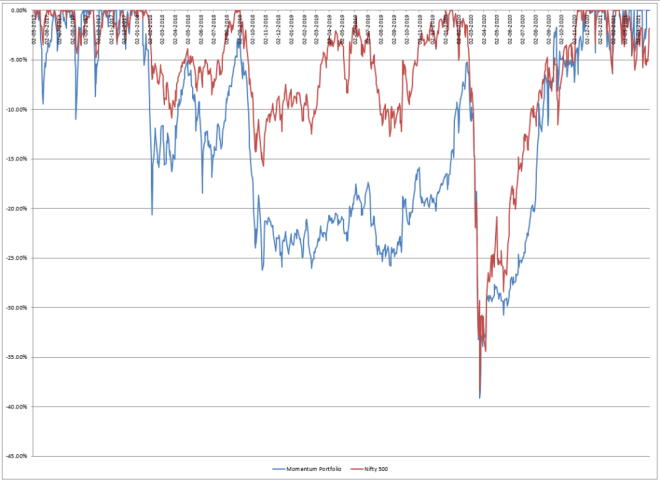

Drawdown:

While risk can be measured in various ways, drawdown is the most visible. Last year when I wrote, I had just experienced the worst drawdown since I had started this portfolio. The portfolio was able to hit the all time high only in November of 2020. The last time NAV had seen an all time high before this was in January 2018. While it was painful not to have a new high for all these times, it was helpful in the sense that it provided me enough time to boost up the capital invested. Capital deployed increased by 335% and hence while in absolute terms the return is still just around 87%, in monetary terms, it has been pretty big.

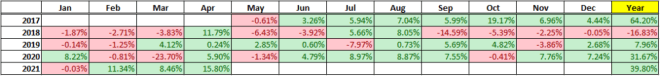

Monthly Returns

Just as sort of record keeping, I have been posting the monthly returns on Twitter. Provides a context with respect to how the market and the model is behaving.

Overall, I feel comfortable with the strategy and its performance. While I am sure that I shall see the Yin and Yangs in terms of performance, I feel the strategy as a whole should hold up over the years and decades to come.

Given the social circumstances outside, this has been an astonishingly good year from the investment perspective. Until next year ..Be Good. Be Safe

Previous Posts:

Year One: Momentum Investing – An Experiment with Real Money

Year Two: 2 Years of Momentum Investing – An Overview

Year Three: 3 Years of Momentum Investing