Is making money in markets easy? Well, its both Yes and No. Yes, if you are positioned rightly, making money is as easy as pie. And No, that does not mean that money can be made without a process driven approach and definitely not by trying the luck in markets when the whole herd of sheep is headed that way.

The simplest way to build wealth is by buying when cheap and selling when expensive. Fundamental Analysts go a long way to analyze what is cheap and what is expensive and while many do get it right, its not something that can be attempted by every other investor who may neither have the time nor the expertise in reading through and understanding balance sheets, cash flows, management guidance among others.

A easier way would be to buy the broader markets when markets as a whole are cheap and selling when they start turning expensive. I have in the past written about how one can use Index PE to determine where the markets are placed at the current juncture and use that info to decide what is the ideal strategy.

So, before we go any further, lets look at the monthly chart of Nifty trailing PE (Standalone)

As can be seen in the chart above, we are well below what can be said as over-valued though the caveat is that the price earnings is based on past earnings and if future earnings are bad, we may see the PE rise even without there being much movement in the Index.

On the other hand, we do have some cushion due to the fact that we use Standalone results to calculate the earnings instead of Standalone which is at a higher keel. But since the data we have is Standalone, we shall stick to that for the time being.

While its true that a picture can say a thousand words, I believe that its better to stick to numbers to be sure of what the chart conveys in reality.

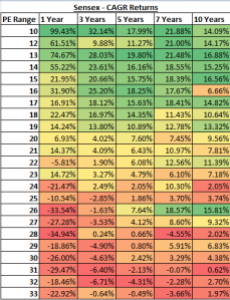

While the above chart if of Nifty, I have used the Sensex PE to calculate returns based on where we entered. The reason for using Sensex data was that it provided me with a much larger sample size compared to Nifty.

What I have tried to do is calculate the Compounded Annual Growth Rates based on where the PE was present at that time. So, if the PE was at 20.5, its returns would be recorded in the 21 frequency (representing all data from 20 to 20.99)

As you can see , the best time to buy would be when the PE ratio is between 10 to 19 and the worst time would be when PE is above 24. Save for the two green picks at 26 PE for 7 years and 10 years, almost all of the rest is the worst returns for the period. Even the outlier is more due to happenstance than something which is worth pondering and investigating further (just for info, the sample size of PE between 25 and 26 is 2 – months of July and August 2000 being the data points). Even in that outlier, do notice that the 1 year return was a negative 33.5%, something that is not easily digestible even by die hard bulls, let alone normal investors.

As on date, Sensex PE is at 18.26 (Source: http://www.vectorgrader.com/indicators/india-sensex-price-earnings) or is at 19.2 (Source: http://www.equitymaster.com/india-markets/bse-replica.asp?order=eps%20desc) .Either way, we are at the top of the band and unless we see strong earnings growth in the coming quarter results, any strong gains from hereon will only push the PE of Sensex into area where the probability is high that returns will be below par.

While I still believe that the markets are a Buy on dips, I would wait for a larger correction to jump in (add to existing positions, that is) than jump in at the first sign of correction.

Your link to the Index PE please..